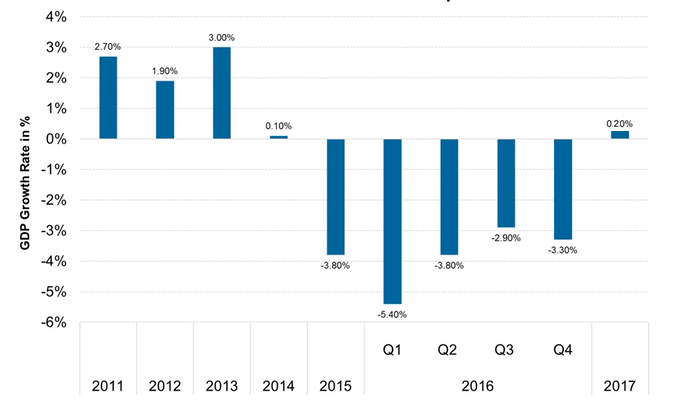

Showing clear signs of recovery, Brazil’s economy is growing at its fastest rate since the peak of the commodity super cycle in 2010, according to the latest Central Bank figures and the Institute of International Finance. The International Monetary Fund GDP growth forecast for Brazil in 2017 has been revised up from flat to 0.2% in their latest World Economic Outlook. This is a significant improvement from the 3.6% decline experienced last year. As economic growth in Brazil is starting to move in the right direction, with forecasts for 2018 pegged at 1.7%, investor confidence is rising, the budget deficit is falling and inflation is plummeting. How has this been achieved? Brazil’s new business friendly and center-right government is successfully implementing profound economic structural reforms.

Economic Growth in Brazil to Pick Up in 2017

Source: IMF and the Central Bank of Brazil (2017)

.

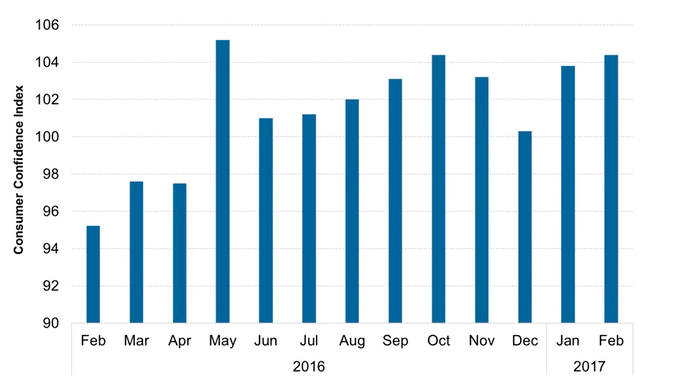

Implementing these reforms, which have ranged from increasing the retirement age to prohibiting public spending to have any above-inflation growth for the next 10 years, has been challenging. Fortunately for Brazil, Michel Temer’s interim presidency has capitalized on the unique opportunity to make the unpopular, yet necessary, decisions for the long-term benefit of the country. The initial success of these reforms has enabled the Central Bank of Brazil to ease monetary policy, slashing interest rates a full percentage point to 11.25% in April 2017. This is expected to drastically increase Brazil’s already strong consumer market as Itau Unibanco, the country’s largest private bank, is planning to pass the rate cut on to consumers using personal loans or overdrafts and small businesses borrowing for working capital.

Increasing Consumer Confidence and Market Performance in Brazil

Source: Central Bank of Brazil (2017)

There is a new awareness in Brazil to strengthen the systemic competitiveness of the economy on an international stage by revitalizing Mercosur, a sub-regional trading bloc promoting trade and the fluid movement of goods, people and currency. This will be accomplished by removing intra-bloc trade barriers, promoting regulatory convergence and engaging in more trade negotiations with key extra-regional partners. According to the latest reports, these include the European Union, the European Free Trade Association and the Pacific Alliance, among others. Such movements are gaining the attention of the Organization for Economic Co-Operation and Development, an institution comprising of the world’s strongest economies. Considered a key influencer in the world’s economic architecture, Brazil has revealed its intention to join the organization. An indication of the Brazilian government’s willingness to implement legislative changes that comply with the OECD tax and transparency rules, membership would boost foreign investment and serve as a guarantee to investors that the country is seeking market-friendly policies. Although the membership process usually takes years, OECD Secretary-General Angel Gurria has signaled that the group could fast track the accession of key partners such as Brazil.

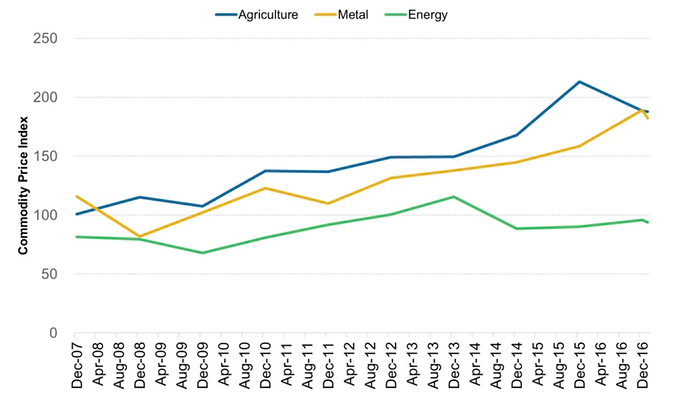

What’s more, the commodity market’s return to form will be a significant catalyst for growth in Brazil. A stronger global economy, an OPEC-production cap and strikes at the world’s largest mines will drive the recovery of global commodities this year. This is great news for Brazil, being one of the world’s largest commodity producers ranging from oil and iron ore to agricultural produce.

Brazil’s Commodity Indexes on the Rise

Commodity Research Bureau (2017)

Excited by these positive economic indicators, investors have begun to flock towards assets in Brazil, with the iShares MSCI Brazil Capped ETF (EWZ) increasing by 11% (outperforming the S&P 500) and the Brazilian Real rising against the US$ by 4.5% so far this year. Brazil raised $1.2 billion in March alone when it auctioned four airports as part of President Temer’s strategy of jump-starting growth via private investments. This has even led to the world’s most prestigious money managers such as Blackrock and Fidelity increasing their exposure to Brazilian assets.

Brazil’s fundamentals remain strong and globally competitive. The world’s seventh largest economy maintains its reputation as an attractive investment destination due to the domestic market of 210 million people, an extensive supply of resources and raw materials, a diversified economy that is less vulnerable to international crises and a strategic geographic position that allows easy access to South America. By capping public spending, cutting regulation, streamlining the pension system and easing inflation, the country is successfully building the foundation necessary for sustainable growth.