We are living in a world where corporate responsibility and investing according to environmental, social and governance criteria is becoming the mainstream. This is not only a result of the challenges the world is facing, which require innovative strategies and a radical change in the way we do business. Investing in sustainability has met and often exceeded the performance of traditional investments, while at the same time benefiting our environment, health and society.

The sustainable and impact investing market offers viable, diverse and profitable opportunities for investors to delve into the newly collaborative international movement to globally address the world’s most pressing matters alongside a competitive financial return.

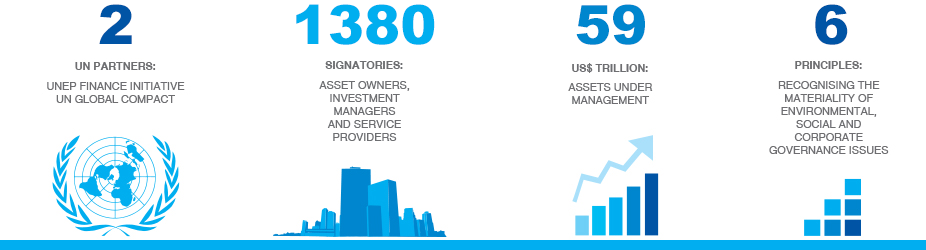

$60 trillion, comprising 50% of the total global institutional asset base, are currently managed by Principles for Responsible Investment and UN Global Compact signatories. In addition, one of every six dollars under professional management in the US is allotted to sustainability investments (a total of $6.5 trillion). Stocks of sustainable companies with strong ESG factors, including climate change risk, human capital management and accountability, tend to outperform their less sustainable counterparts by 4.8% annually.

Source: UN Principles for Responsible Investment (2016)

Sound ESG practices have resulted in better operational performance, according to research by Deutsche Bank, Morgan Stanley and the University of Oxford. The results also reflected that the most relevant issues on environmental corporate practices included pollution abetment, resource efficiency and raw material sourcing. On the other hand the social practices that most positively influenced the operational performance were employee and community relations together with health and safety.

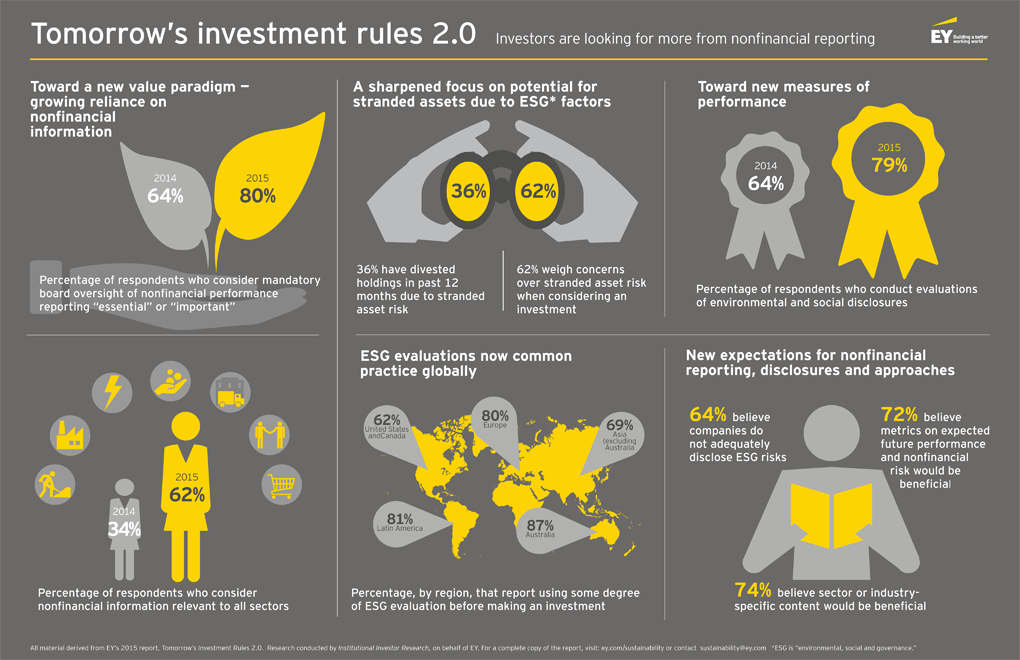

The governance aspect of the ESG issues impacted the performance more evidently with matters of executive compensation, antitakeover mechanisms and transparency.

Source: EY (2016)

Due to the interest expressed by investors on environmental, social and governance issues over the last few years, and the evidence that properly internalizing superior sustainability practices can mitigate risks by promoting pre-emptive action, 72% of S&P 500 firms are now reporting on sustainability. This is a drastic increase form the 20% reported in 2011.

Ignoring these practices today creates an unsurmountable risk for any corporation. The ten largest fines and settlements in corporate history for neglecting ESG and sustainability issues amount to more than USD $45 billion, , reminding decision-makers that ‘business as usual’ is no longer a viable option.

The responsibility of prioritizing the agendas of global finance to increase the social value of corporations across the globe, while facing the challenges of a sustainable world, is now in the shared hands of businesses, investors and users through ESG factors, impact and sustainable investment and consumer choices respectively.

There is a growing commitment in financial markets towards environmental, social and governance criteria within investment decisions. The orientation towards long-term and responsible investing will become fundamental in achieving higher returns alongside global sustainability. Combining these two objectives into one powerful strategy will ensure a new age for corporate social responsibility.