The world’s social and economic challenges are well known, ranging from rising populations, massive resource consumption, unprecedented debt levels as well as slowing global economic growth. Only now are they starting to have an impact on the economy as the conditions that led to the three decades of impressive returns are beginning to show signs of weakness. This is why organizations that deal with sustainable solutions to these problems offer long-term investors welcome relief.

The environment of low interest rates and excess capital brought on by $12 trillion in quantitative easing programs over the past eight years has fueled the appetite for risk when hunting for investment returns. While this has had positive effects, with stock markets around the world, including the S&P 500, Nasdaq and FTSE, all enjoying record highs, the willingness to take on more debt has ultimately inflated traditional asset valuations across the board. Using the most recognized market valuation indicator, the Shiller price-to-earnings multiple for the S&P 500 has reached 28x the historic average of 18x since 1950. That means a 45% drop in value is needed to revert to long-term averages. This valuation has only been higher on two previous occasions – the Wall Street Crash in 1929 and the Dot-Com Bubble in 1999. We have already surpassed the level seen at the start of the Global Financial Crisis in 2007.

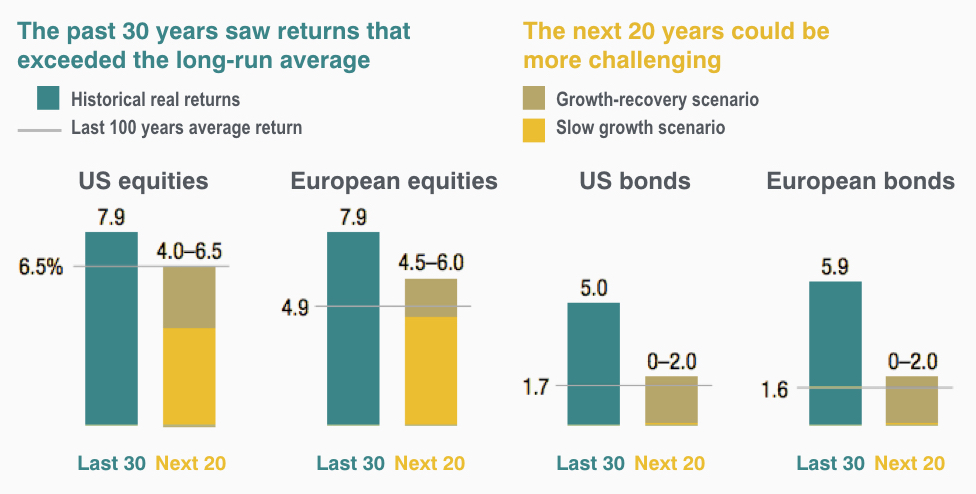

From 1985 to 2014, annualized returns for both US and European equities averaged 7.9%, compared with 100-year averages of 6.5% and 4.9% respectively. Real bond returns over the same period averaged 5% in the US and 5.9% in Europe, compared with 100-year averages of 1.7% and 1.6%. These impressive returns were underpinned by a confluence of four highly beneficial economic and business conditions: lower inflation, falling interest rates, strong global GDP growth and global productivity gains. Each of these four conditions has now either weakened or reversed. In the midst of a global macroeconomic environment of waning growth and rising interest rates, McKinsey, UBS and Vanguard are bracing themselves for returns over the next 20 years falling to long-term averages.

Source: McKinsey (2017)

Source: McKinsey (2017)

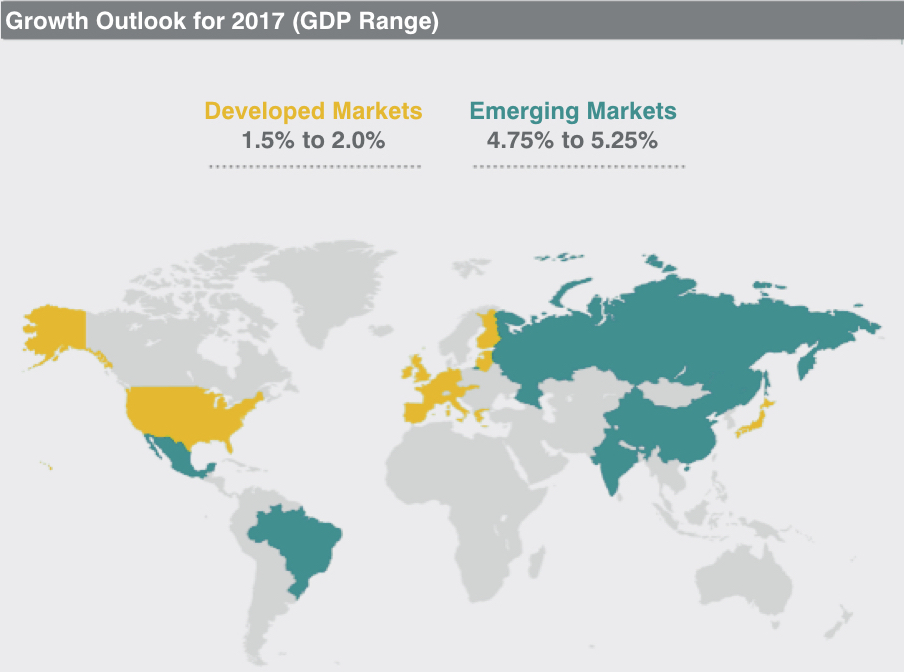

Regarding future global economic prospects, an average 2% growth is expected across developed markets and 5.25% for emerging markets over the next fifty years. While prospects have improved recently, this is still a substantial downgrade to the 7% average growth experienced in the first decade of the 21st century.

Source: McKinsey (2017)

Source: McKinsey (2017)

This new investment outlook for traditional asset classes has caused investors worldwide to diversify away from equity and fixed-income products and opt for alternative, tangible and risk-adjusted asset classes. By 2030, allocations to physical and alternative assets among institutional investors is expected to reach 20-30% of total portfolio value, with some institutions allocating upwards of 50% to the asset class. This transition in portfolio allocation towards alternative assets has only just begun. Blackrock expects real assets, including infrastructure and farmland, to enter the limelight in this new investment landscape. Long-lived physical assets that generate stable cash flow streams, such as agriculture, provide enhanced yields and offer attractive risk-adjusted returns.

Farmland is one such alternative asset. The fundamental drivers will always remain – an expanding global population and a limited supply of the world’s most fundamental resources. The asset has also experienced strong performance in recent years, with the Savills Global Farmland Index has increased by 14.8% each year since 2002 and 6.6% from 2010-2015 (p.a.). According to TIAA CREF, one of the world’s largest institutional investors in farmland, US agricultural land values outperformed domestic stocks and bonds between 1970 and 2013 (generating average annual returns of 10.3% vs 6.2% for the S&P 500 and 7.3% for 10-year Treasuries). The Brazilian nationwide average farmland price was pegged at $2,530 per acre, versus just $627 ten years ago. That’s a compound annual growth rate (CAGR) of 15%.

Agriculture provides the necessary services to support a thriving economy and ensure global health. The case for increasing exposure to alternative assets such as agriculture is simple. Food is one of mankind’s most primal needs and it offers an added benefit of diversification from more traditional assets.