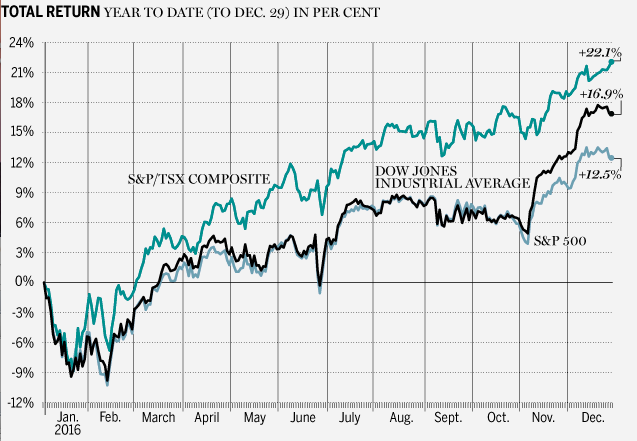

Global financial markets have started the New Year on a surprisingly strong footing, with the Dow Jones, FTSE and US$ all outperforming expectations and achieving record-highs. Why the unprecedented optimism so early on in the year? Investors are expecting significant change for global financial markets, characterized by the profound shifts taking place in monetary and government policy worldwide.

After an Impressive 2016, Where Will Markets Move?

Source: Bloomberg News (2016)

Source: Bloomberg News (2016)

Investors should brace for few certainties, several headwinds and many opportunities in the New Year. Donald Trump will see his first days as President of the United States, the British government will begin proceedings to leave the European Union, there is risk of a supply war over the world’s most important commodity, oil, and interest rates are likely to rise around the world.

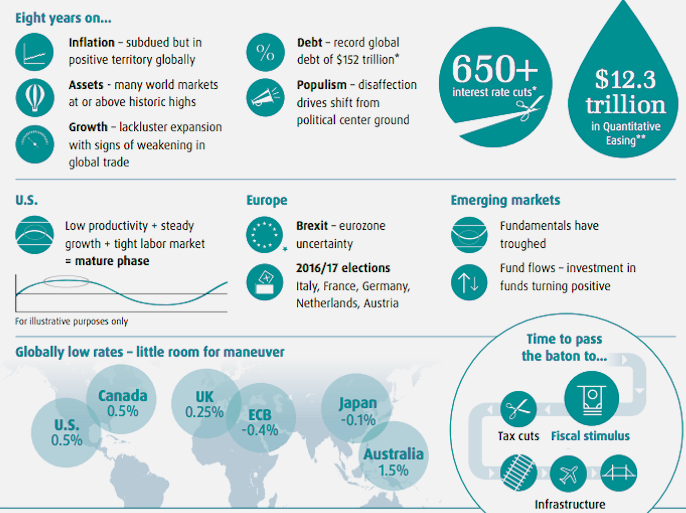

For global financial markets, the era of the Central Bank is finally coming to a close. Since the financial crisis, Central Banks have kept interest rates at historically low and even negative levels to help ensure growth and inflation. The European Central Bank currently buys $84 billion in government and corporate bonds every month, The Bank of England is buying $545 billion in government bonds and corporate debt and the Bank of Japan even holds a significant position in local equity markets. Having dominated trading across equities, bonds and other alternative assets in recent years through quantitative easing and excessive asset purchasing, investors will now expect economic performance to catch up as a key driver of growth rather than monetary policy alone. This reflects a return to a world in which fundamental data and value, ranging company profitability, credit risk and growth opportunities will matter much more than the cryptic words of central bankers. While we expect economic recovery to remain slow and steady for the majority of the year, tightening monetary policy and brighter economic fundamentals around the world will help ensure growth.

Policymakers’ Bid to Counter Deflation, Support Asset Prices and Help Economies after the Global Financial Crisis

Source: BMO Global Asset Management (2016)

Source: BMO Global Asset Management (2016)

With this in mind, we expect emerging markets to be the focus for savvy investors in 2017. Why? Emerging markets are currently undervalued and offer great prospects for rapid economic growth. Real GDP for developing economies is expected to grow by 4.6% this year, according to the International Monetary Fund, compared with a painfully slow 1.6% growth forecast for advanced economies. We expect to see a stronger recovery from commodity exporters in the short term, with the Bloomberg Commodity Index rising nearly 12% in 2016 (the first annual increase since 2010). Long-term prospects remain supported by youthful and increasingly well-educated populations, while a rising middle class will inevitably boost consumption-led growth. Our money is on Brazil. The new government’s shift towards the political center-right combined with their continued implementation of business-friendly initiatives will help reignite the economy, signaling an end to the era of lackluster recovery and catalyze a return to form for one of the world’s most important breadbaskets.

With so many headwinds lining up ahead of investors, there is an element of uncertainty in forecasts for the New Year. Even so, global financial markets have started off strong, with investors excited by the prospect of new opportunity. While the words of politicians and central bankers will undoubtedly move stock markets throughout the year, assets that hold fundamental value will ultimately set the bar once the hype settles.