The case for increasing exposure to alternatives rests on wonderful simplicity – investors are lacking these assets in their portfolios, just at the time when returns generated from traditional investment vehicles are falling. Since the global financial crisis, diversifying away from long-only equity funds and fixed income investments is critical as traditional tools of risk management are becoming less and less effective. For investors who want attractive yields and risk-adjusted returns with a higher degree of diversification, alternatives are a natural choice.

Alternative investments provide the foundation for the delivery of goods and services necessary to support the global economy, and therefore the drivers of end-user demand for these assets are predictable, sustainable and persevering.

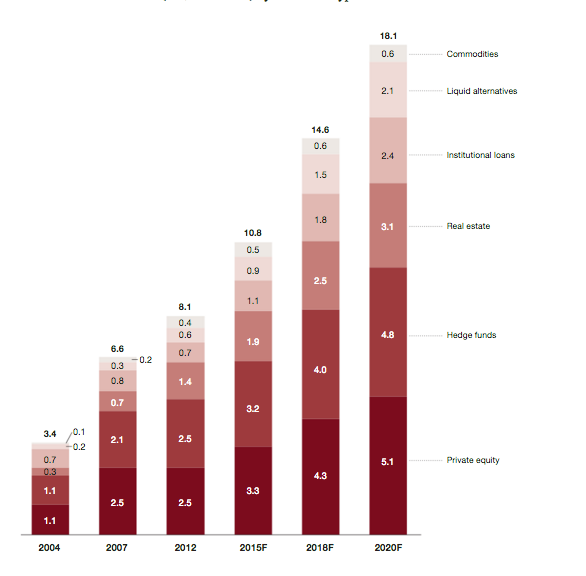

By 2020, global assets in alternative investments will nearly double in value to $18 trillion from $10 trillion today. Meanwhile, Morgan Stanley forecast the traditional equity/bond/cash split of 60%/35%/5% will generate average returns of only 3.9%, with volatility of 13.5%. This equates to a 40% reduction in returns but a 30% increase in volatility compared with the previous 25 years. No wonder allocations to physical and alternative assets among institutional investors is expected to reach 20-30% of total portfolio value by 2030, with some institutions allocating upwards of 50% to the asset class.

Global Alternative Assets (US$ trillion) by Asset Class Type

Source: PWC, Alternative Investments – It’s Time to Pay Attention (2015)

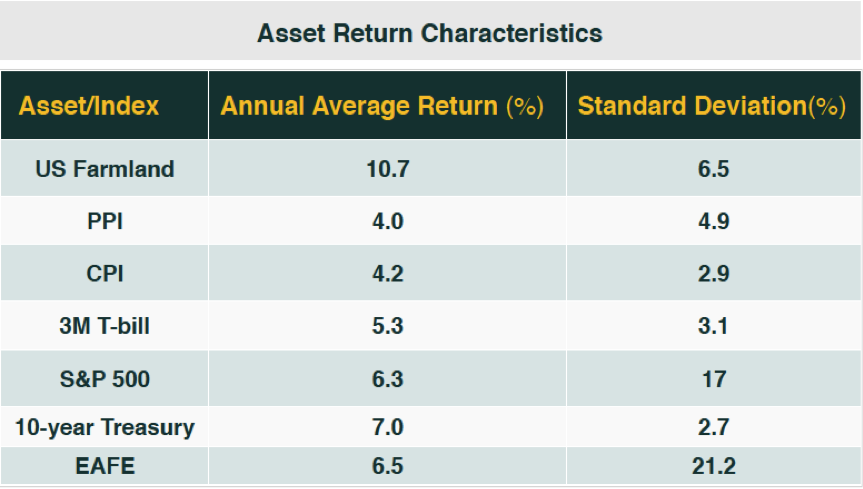

Agricultural farmland is set to become one of the most fundamental and lucrative alternative assets. The Savills Global Farmland Index has increased by 20% each year since 2002. In the US, farmland values rose by 50% between 2009 to mid-2013, while in Brazil, soon to be the world’s largest foods exporter, land prices have risen by an average 20% in each of the past three years. According to TIAA CREF, one of the world’s largest institutional investors in farmland, US agricultural land values outperformed domestic stocks and bonds every year between 1970 and 2009 (generating average annual returns of 10.3% vs 6.2% for the S&P 500 and 7.3% for 10-year Treasuries). The World Bank Annual Food Index has also risen by 73% in the 10 years leading to 2012, at a compound annual growth rate (CAGR) of 6.6%.

Source: TIAA-CREF Center for Farmland Research, Standard & Poor’s, Federal Reserve, Commodity Research Bureau, Consumer Price Index (2015)

These factors are generated by a simple set of drivers that are likely to remain relevant in the years ahead:

Supply-demand dynamics: The Food and Agriculture Organization (FAO) forecast that a 70% expansion in global food production is needed by 2050. This is due to a relentless rise in our global population. The UN continues to revise its population forecasts upwards; the latest revision suggests that by 2050 the world’s population will reach 9.6 to 10 billion. During the last 50 years this has nearly tripled from 2.5 billion to 7 billion people, and has more than doubled since 1970.

The availability of farmland is shrinking worldwide: The UN estimates that the current rate of global arable land degradation of 12 million hectares a year (equivalent to 29.6 million acres) is 30 to 35 times the rate experienced during the mid-twentieth century. This costs the global economy $490 billion per year due to lost production. Rising urbanization, damage resulting from chemical pesticides, deforestation, overgrazing and the impact of global warming are all contributing to the process by which the soil loses its productivity and vegetation cover disappears.

Rising consumer demand for food together with shrinking levels of available farmland are forecast to drive the value of farmland and food prices higher. The conflux of factors above will be responsible for a 60% price increase in food and commodity staples such as corn, wheat and rice by 2050.

Reasons for investing in farmland strike at the heart of one of the key components of primal investing. It is an asset essential for life on this planet. As a financial asset it is also a source of dependable investment returns. Strong macroeconomic fundamentals, including global population growth, improving consumption in the developing world and shrinking farmland, will lead to increasing and sustained demand for agricultural commodities.