“Brazil is offering some of the most interesting investment opportunities across asset classes in emerging markets.”

– UBS Investment Management, 2016 –

While the first athletes arrive in Rio for the Olympic Games 2016, there is a great sense of excitement and hope for Brazil as the country demonstrates the underlying strength of their economy on the verge of a profound recovery.

Over the past several years the emerging markets that are actively pursuing a reform agenda in governance towards the center-right have seen a huge level of outperformance even in these difficult times for global financial markets. Mexico was one of the first in 2012 with the election of Enrique Pena Nieto, followed by India and Indonesia in 2014 with Modi and Jokowi, and most recently in Argentina with the election of Mauricio Macri in October 2015. Brazil will be next.

Consumer and Industrial Confidence Have Rebounded Since Temer Took Over

Source: Bloomberg (2016)

Global investors continue to be impressed by interim President Michel Temer’s market friendly approach as well as his newly appointed Finance Minister Henrqiue Meirelles and Central Bank President Ilan Goldfajn. Referred to by Goldman Sachs as the ‘economic dream team’, these are the men tasked with restoring investor confidence and economic prospects in Brazil for the long term and they have already made significant headway. The second half of 2016 will continue to bring about a visible improvement in economic activity for Brazil and this will be mainly due to the new political team behind the wheel.

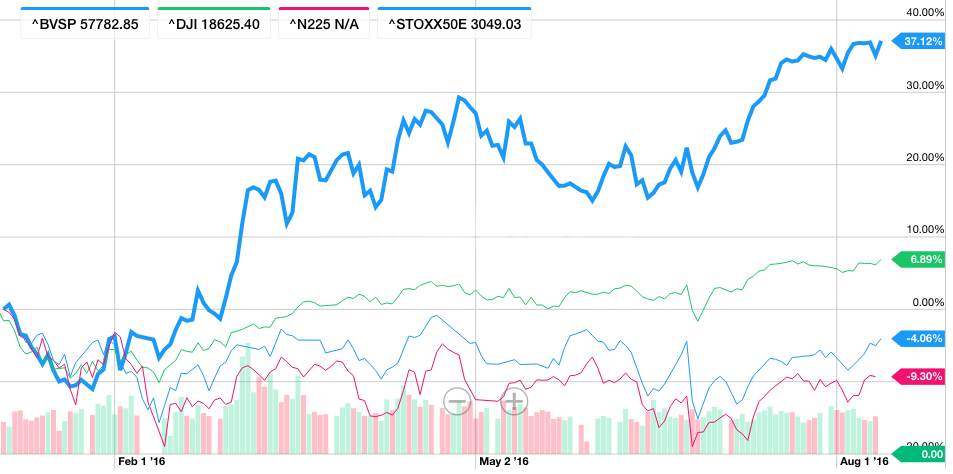

The Ibovespa, Brazil’s benchmark equity index, has soared by 37% this year while their overseas government bonds have returned a market leading 26%. As a point of comparison the Dow Jones has risen by 7.8% year-to-date, the Stoxx Europe 600 has dropped by 6% in the same period and trillions of dollars of government bonds from around the world are trading at negative yields. The 21% rally the Brazilian Real experienced against the US$ so far this year is also the highest experienced in any global currency and has further strengthened the foundation for impressive returns in the country’s stock and bond markets.

Brazil’s Ibovespa Growth Remains Ahead of the Pack

Ibovespa (Bold Blue), Dow Jones (Green), Nikkei (Pink) and Stoxx (Thin Blue) – YTD (%)

Source: Yahoo Finance (2016)

Even after this run in prices, analysts say there are many more gains to be had in Brazil. Inflation has fallen below 9% and is expected to fall below 7% by year’s end, extremely close to the Central Bank’s target of 4.5%. Even the current account deficit, which reached 4.4% of GDP in Q1 2015, is now non-existent as Brazil is running at a current account surplus for the first time since 2007. The International Monetary Fund expects a more favorable environment for the Brazilian economy returning to growth as soon as next year. This is positive news following the back-to-back contractions experienced by many emerging markets and export driven economies during the recent downturn following the commodity supercycle.

Agriculture is not only a significant segment of the Brazilian economy but also for the future prospects of global food security. Currently ranking third in the world’s major agricultural exporters, and fourth for global food production, Brazil will hold a 10% share of global agricultural trade over the next five years. Brazil’s dominance in agricultural production looks to be unassailable. If anything, it will increase over the next few decades due to Brazil’s competitive edge. The country has more freshwater than any other country in the world, twice as much as Russia (its closest rival), circa 300 million hectares of arable farmland (of which only 14% of this is currently in use) and highly favorable weather conditions for agricultural production.

With the Olympics around the corner, Brazil will be dominating the headlines. Not only for the country’s exotic landscape and vibrant culture but also for its position as the major engine of the Latin American economy and a future breadbasket for the world.