Michel Temer was sworn in as the official President of Brazil on the 31st August 2016, marking a new era for Latin America’s largest economy as the country embarks on a journey of growth and prosperity that will secure its place as a model for emerging nations around the world.

After a historic and at times fierce impeachment trial, the Brazilian Senate voted 61-20 in favor of convicting Ms. Rousseff on charges that she used illegal bookkeeping maneuvers to cover government financing. By delaying repayments to state-owned banks for her world renowned social programmes, which propelled millions of people out of poverty, Rousseff’s administration was able to exceed their budget while appearing to stay within the legal bounds. Mr. Temer, his Brazilian Democratic Movement Party (PMDB) and his chosen ‘dream team’ of political and economic advisors will now officially take over Rousseff’s second term, which will last until the end of 2018.

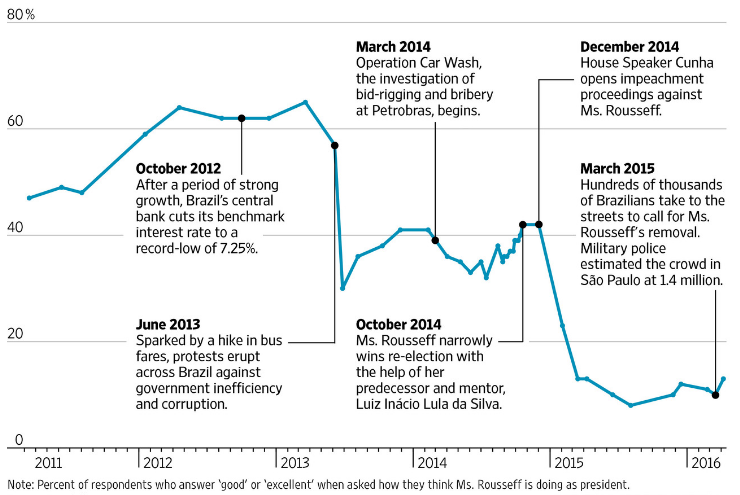

Dilma’s Decline

Source: Wall Street Journal (2016)

Source: Wall Street Journal (2016)

In his first official address to the nation, Mr. Temer pledged to unite Brazil, strengthen the country’s economy and guarantee social and political stability for foreign investors. With his impressive track record of supporting tighter fiscal austerity and privatization programmes, having rescued the country from economic adversity once before, this new government represents a very welcome political shift towards the center-right for Brazil. Mr. Temer has a pro-business agenda, courting investors with plans to deregulate the labour market, stabilize public debt, sell public assets and secure a more stable environment for domestic and international commerce. He has also made significant efforts to streamline the authorization of environmental and agricultural permits, a huge win for us as our projects in the country continue to grow at an impressive pace.

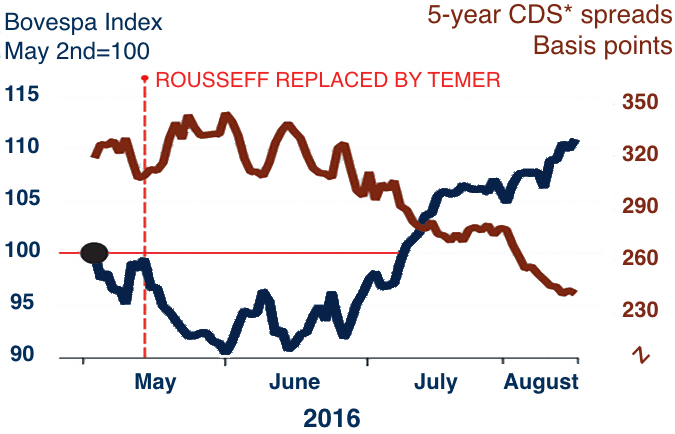

Even the mere prospect of Mr. Temer’s Presidency boosted investor confidence in Brazil during Rousseff’s impeachment proceedings. The Ibovespa boomed, soaring 33% in dollar terms so far this year, while overseas government bonds have returned a market leading 26%. Around the world the Dow Jones rose by 7.8% year-to-date, the Stoxx Europe 600 dropped by 6% in the same period and trillions of dollars of government bonds have been trading at negative yields. The 22% rally of the Brazilian Real against the US$ also happens to be the highest experienced by any global currency in 2016. The International Monetary Fund has even increased its projection for Brazilian GDP growth as early as 2017, expecting an expansion of 1%. This is good news following the recent back-to-back contractions experienced by many emerging markets and export-driven economies around the world.

The Temer Effect

Source: The Economist (2016)

Source: The Economist (2016)

Mr. Temer has appointed a blue-chip economic team headed by Finance Minister Henrique Meirelles, former head of Brazil’s Central Bank, to jump-start the economy and increase investment prospects for the country. With consumer and corporate confidence improving, alongside a drastic increase in retail sales and industrial output in recent months, there has already been an influx of new foreign investment. Multinationals such as Renault, Albaugh LLC and BYD Energy have all taken the opportunity to expand their operations in Brazil while global financial heavyweights such as Goldman Sachs and UBS Asset Management increase their exposure to the country’s attractive asset opportunities.

Mr. Termer left Brazil hours after Rousseff’s impeachment was finalized in order to attend the G20 Leaders Summit in China. In September he will attend the United Nations General Assembly in the United States and then in October head to the BRICS Leaders Summit in India. This global tour of some of the world’s major economies is no coincidence. The main objective will be to attract further investment as well as to demonstrate the social, political and economic strength of Brazil to the rest of the world.

The future is bright for Brazil as the country retains its position as the major engine of the Latin American economy and future breadbasket for the planet. Fresh leadership, combined with a return to greater fiscal responsibility and monetary policy demonstrated over the past few months, are the necessary catalysts for further change and development in a country that has achieved serious credibility on the global stage over the past century.