“The only investors who shouldn’t diversify are those who are right 100% of the time”

– Sir John Templeton –

The need for asset diversification has never been greater. Subdued financial markets against the backdrop of very high geopolitical tensions around the world is cause for significant concern in the eyes of investors and will drive a return to the diversified portfolio.

Although investors have generally experienced strong asset class returns since the Great Financial Crisis, those returns have been supported by some extraordinary and unprecedented monetary policies around the world in the form of Quantitative Easing. The US Federal Reserve, the Bank of England, the European Central Bank and the Bank of Japan have all embarked on QE in an attempt to stimulate growth and inflate asset prices. Between 2008 and 2016, US Federal Reserve, the European Central Bank and the Bank of England in total bought bonds worth more than $5.6 trillion. With the US beginning its rate hiking cycle in December 2015, signalling the end of QE, monetary policy will likely be less of a support for asset prices than it has been over the last few years.

Overevaluated no matter how you look at it

Meadian price/earnings & price/sales ratios

Source: Ned Davis Research

Source: Ned Davis Research

There is little doubt the global economies have been distorted as a result of the credit binge experienced over the last decade. Mainstream investment performance during 2016 and beyond will be affected as markets acclimatize to a new financial environment. Rate rises are on average bad news for equity and bond investors. In a Credit Suisse analysis of annual data covering 21 countries over the period 1900–2015, real equity and bond returns tend to be higher in the years following rate falls than in the year after rate rises. Let’s not forget the added fiscal pressures of global debt that has reached $152 trillion, more than twice the size of the global economy. The additional $78 trillion in retirement related debt is equivalent to a single year of global economic output.

Morgan Stanley forecast the traditional equity/bond/cash split of 60%/35%/5% will generate average returns of only 3.9%, with volatility of 13.5%. This equates to a 40% reduction in returns but a 30% increase in volatility compared with the previous 25 years.

Applied correctly, diversification is ‘the only free lunch in financial markets’. In an environment beset by growing uncertainty and negative news flow, this remains the best strategy for private investors looking to spread their risk while maximizing growth. In the decade between 2001-2011, the S&P 500 Fund Index returned an average 1.4%. According to Index Fund Advisors, investors with diversified portfolios saw a 5.7% return during the same period.

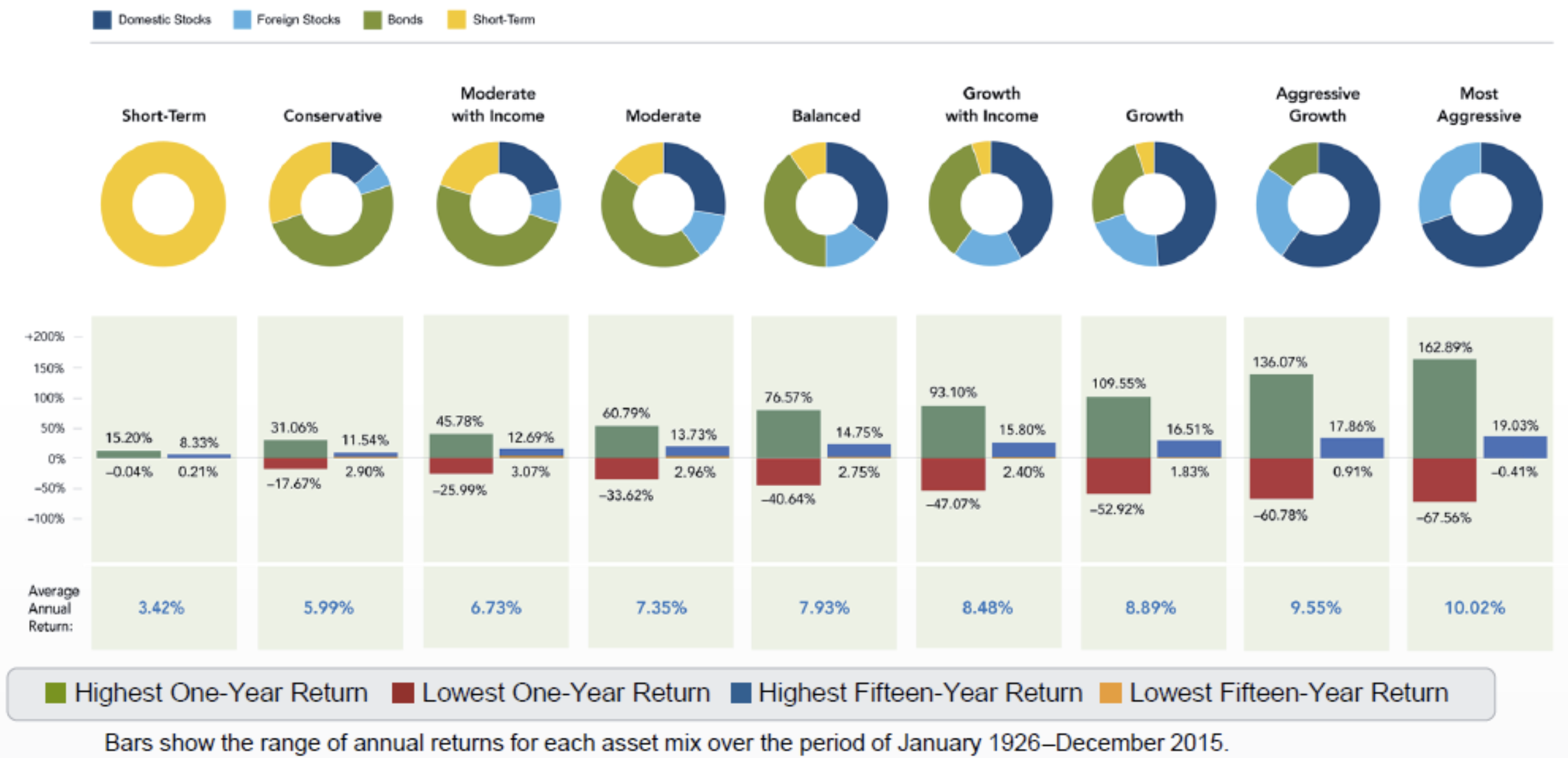

The Impact of Asset Allocation on Long Term Performance

Source: Fidelity Investments (2016)

The Impact of Asset Allocation on Long Term Performance Source: Fidelity Investments (2016) With any investment there is risk. A diversified portfolio will reduce the overall risk of investments, limit losses and account for uncertainty through exposure to a variety of geographies, currencies and markets. For Primordiales, a focus on high growth alternative assets such as agriculture in Brazil allows investors to capitalize on the country’s unique position and strengths. An exciting diversification vehicle, Brazil is a Top Ten Global Economy with a free-floating and independent currency with high foreign currency reserves and competitive levels of foreign direct investment.