2016 is set to be an eventful year for the global economy. There will be presidential elections in the United States and Taiwan, Brazil will host the Summer Olympics, the United Kingdom will reconsider its place within the European Union (EU) and China will finalize a new five-year plan for local economy, demographics and innovation.

With the European debt crisis and China’s staggering economic slowdown compounding fears of a global financial system teetering on the edge of recession, the modest but steady growth in global gross domestic product (GDP) over the past five years speaks otherwise. Although we did not witness the major acceleration in global GDP growth expected from the trend of low oil prices, wage gains and resurgent consumers around the world, the global economy has still maintained a steady course of growth. Renowned forecasters and policy makers are therefore speaking of the same baseline scenario for 2016 – yet another year of the same. China will most likely continue to decelerate, with the country’s new-normal GDP growth at below 7%. The United States will outperform its peers of developed nations, with a strong US dollar, high employment rates and low levels of debt. With global demand weakening, interest rates worldwide are likely to remain subdued.

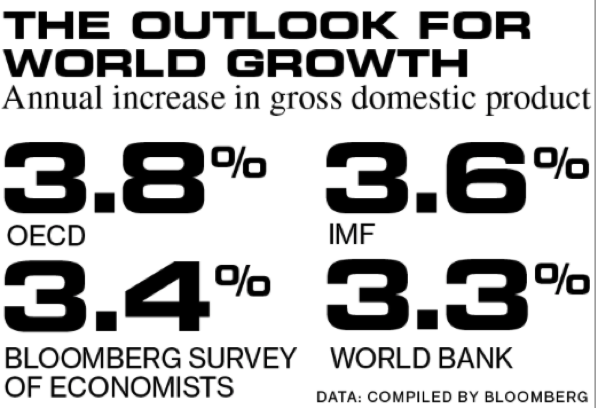

According to the International Monetary Fund (IMF), the global economy in 2016 is likely to be marginally stronger than in the previous year (Global Gross Domestic Product growth has averaged 2.2% since the Global Financial Crisis and 2.5% over the last two years) and in line with longer-term growth averages. Forecasts place growth at similar (although slightly higher) levels for 2016.

What to look out for in 2016:

A New Normal of Low Growth in China

One of the most important factors for the global economy in 2016 is China, where annual GDP growth rate fell below 7% in 2015 for the first time since 2008. An even sharper slowdown would cause a similar situation in emerging markets (due to their reliance on China as a customer for their resources) while impeding growth in developed economies. China simply has no more need for the significant infrastructure it has been developing at home. With new attempts to guide the economy towards more domestic consumption, China will find itself in a rather difficult position throughout 2016.

A Lower Oil Price

Oil prices in 2016 are expected to be as unpredictable as the Chinese economy due to already tense geopolitical factors in the Middle East and stubborn OPEC policies to maintain current levels of production. The price of crude will remain between the $40-50 per barrel mark this year due to production exceeding demand and an inability to store the excess. A lower oil price is now becoming a key factor in global economic growth, as the commodity’s cheapness will hit exporters and improve prospects for importers throughout Latin America, Africa and Asia.

A Precarious Time for the European Union

With the Greek Financial Crisis remaining unresolved, and one of the most severe refugee crises in Europe dominating the headlines, the stability of the European Union is under threat. The United Kingdom, currently relieved to have kept the Pound Sterling currency, is hosting a referendum in October that will determine the country’s future membership to the EU. If the UK leaves, confidence in Europe will drop.

One of the Strongest El Niño Events Since 1950

2016 will see one of the strongest El Niño events since 1950, causing major disruptions, widespread droughts and severe floods around the world. The El Niño of 1997 killed at least 30,000 people and caused $100 billion in damages. This weather pattern, which affects winds and water temperatures and changes precipitation levels worldwide, is an added risk to our food supply and could potentially cause a spike in global agricultural prices.

The global investment landscape is also changing. Financial markets are more scrutinized than ever before, whether from individual economic data to the frequent utterances of Central Banks worldwide. While these analyses drive up asset prices, they also increase volatility in the markets. The 24-hour news cycle and instant communication technologies encourages rapid fluctuations in the markets and nurtures a financial culture that focuses on the short-term. For investors who are more interested in longer-term and sustainable gains, the bigger picture is what will matter most.

Steady yet modest growth will be a common theme for 2016, and maybe even for the foreseeable future. Acclimatizing to this new normal of global growth should not concern investors, as the fundamental value of real assets such as agriculture remains.