Behind the series of multibillion-dollar mergers between the world’s largest agrochemical firms is a profound change in global farming. The authority of genetically modified crops in global agriculture is under threat. For organic alternatives in the agrochemical space, the opportunity has never been greater.

In a $57 billion deal that will create a global agricultural powerhouse and end the autonomy of one of the most prosperous and contentious companies in the United States, Bayer AG has acquired Monsanto. Monsanto’s merger with Bayer, the chemical and pharmaceutical company most famous for producing Aspirin, is the largest-ever foreign takeover bid from a German company. Both companies produce pesticides and together will control 28% of the global pesticide market. This joins the long list mergers between agrochemical firms such as Canadian fertilizer giants Agrium and Potash in September, ChemChina and Syngenta in February and Dow and Du Pont at the end of last year. The series of deals announced over the past year would place more than 80% of U.S. corn-seed sales and 75% of the global pesticide market under the control of just three companies, causing fresh concern over the consolidated power of the sector’s largest players.

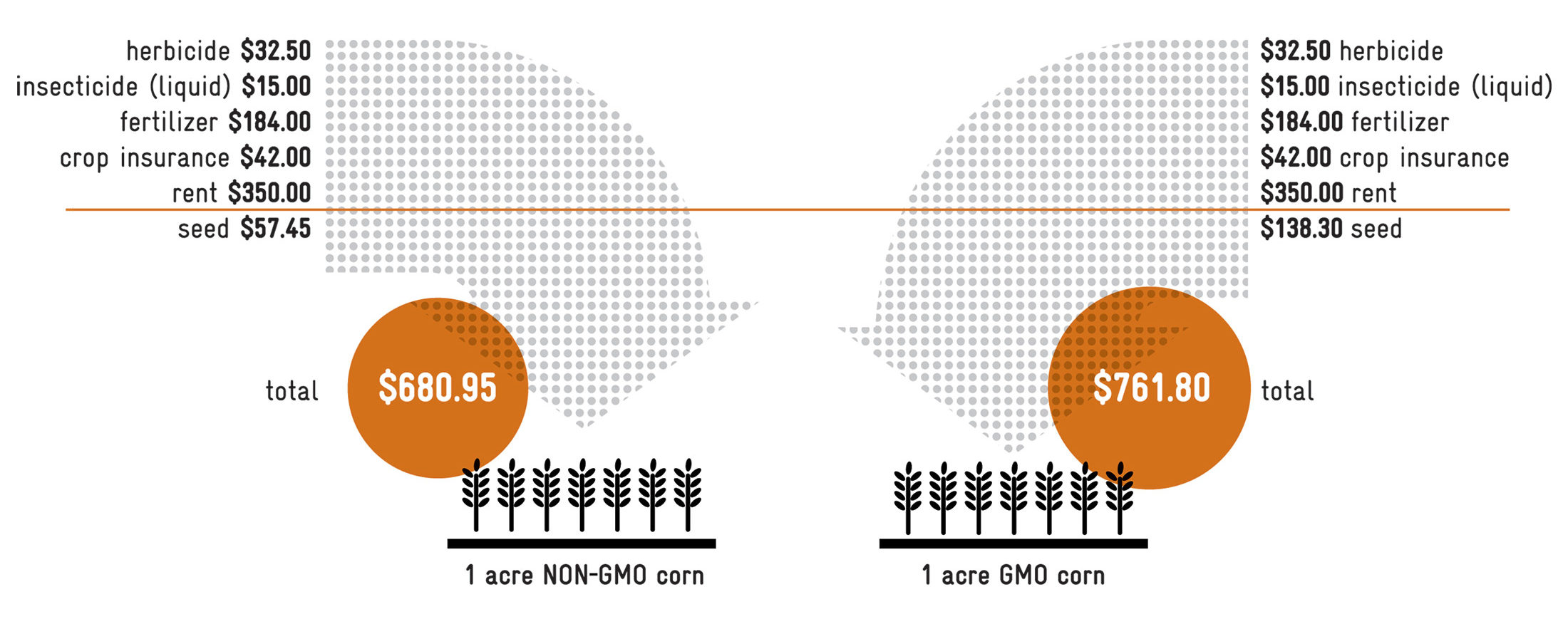

It is important to remember that these monumental shifts in the agricultural space have come during a period of depressed returns for giant agrochemical firms as farmers around the world move away from the high and often rising prices for genetically modified organisms (GMOs) in agriculture and look towards greener pastures.

The Economic Case for Natural Crops

Source: Modern Farmer (2013)

Biotech seeds and crops were originally engineered to thrive alongside a single, all-purpose and often same-brand agrochemical pesticide and fertilizer. Monsanto and other agrochemical giants charged a premium for these seeds and inputs, theoretically sharing savings with farmers who would thereby spend less on other chemicals and labour. This was untrue has seed prices have increased up to 305% over the last thirty years while crop prices have risen by a comparatively low 31%. Crop yields simply have not kept up with the rising costs of GMO seeds and farmers around the world are realizing that they just do not deliver harvests big enough to justify the price. Yet another challenge for the industry is in terms of innovation as it costs the best part of $223.1 million and 11 years to successfully bring a new product to market.

A series of compounding issues in GMO and synthetic agrochemical use has also taken its toll on our environment and global health. Scientists have confirmed that a variety of weeds and pests have developed resistance to the most popular synthetic agrochemicals on the market, often leading to the use of older and more dangerous iterations especially across developing countries around the world. Aside from the environmental degradation and biodiversity loss associated with the use of these synthetic pesticides and fertilizers, some of these chemicals are known to have caused a variety of health issue ranging from cancer, leukaemia and Parkinson’s disease.

This has led to a surge in legislative action against these products around the world and particularly across Europe. The European Commission has announced that 19 European Union States, or two-thirds of the entire trading bloc, will ban the cultivation of genetically modified crops as well as the use dangerous agrochemicals such as glyphosphate over the course of the year. On the other side and in order to strengthen and secure our global food supply, 87 countries have introduced legislation that supports the adoption of organic agriculture.

Since biotech farming isn’t working as well as it once did, combined with the added pressures of increasing cost and the associated environmental impacts, farmers and consumers alike are opting for more natural and organic alternatives. Organics have certainly become a source of prosperity for our farms, our food and our future and the giant agrochemical institutions of the world are taking note.