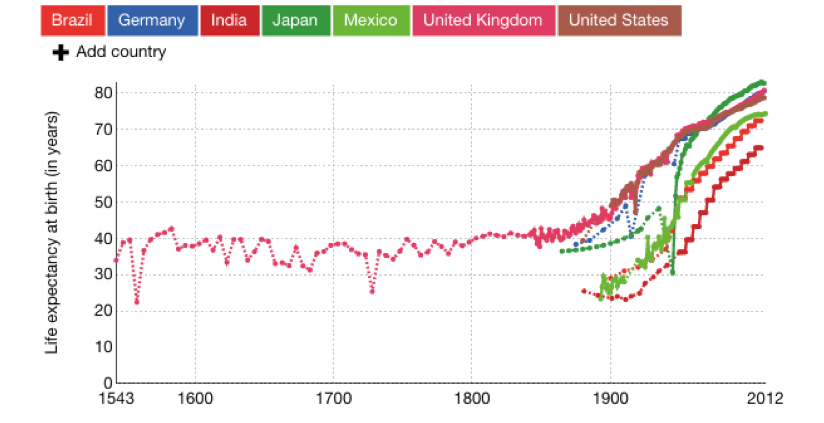

In their latest white paper on Secular Stagnation, Federal Reserve economists concluded that real GDP growth and real interest rates are expected to remain low in the coming decades as the global economy acclimatizes to a new normal. One reason can be found in Jeanne Lousie Calment, the oldest woman on record, who reached the age of 122 years old. Having witnessed an unprecedented era of human innovation, from the invention of the radio to over 70 million people accessing the Internet, her life represents a profound shift in demographics affecting our population today. Bear in mind a little over 100 years ago the average lifespan around the world was 30 years old. Life expectancy has doubled from 40 to 80 years since 1900 and the proportion of people who reach the age of 65 has increased three fold from 30% of the population to 90%. The United States Administration on Aging estimates that the amount of people aged 60 or older will increase from 19.4% in 2010 to 22.2% in 2020. This change represents the biggest percentage increase in the over 60 population that the world has ever seen.

Life Expectancy, 1543 – 2012

Source: United Nations Population Division (2016)

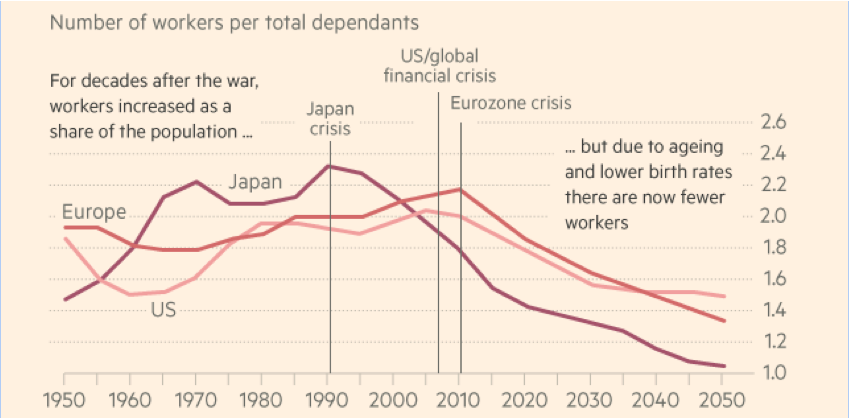

An aging workforce can hit the economy in a variety of ways, from a greater portion of the population leaving the workforce and entering retirement to the increase in fiscal burdens as more people become eligible for social security programs. Since 2008 the number of Social Security beneficiaries in the United States increased from 41 million to 49 million and the labor force participation rate slumped to 62.4% – the lowest in nearly 40 years.

Researchers at the RAND Corporation found that US GDP growth will slow by 1.2% this decade due to population aging alone. For comparison the US economy grew at an average rate of 1.8% over the past 50 years once you adjust for inflation. The International Monetary Fund has also come to the same conclusion, finding that an aging workforce will reduce productivity growth in the EU by 4% over the next 20 years. Our aging populations have become the single largest factor in the 1.25% decline in the natural rate of real interest and real gross domestic product growth since 1980.

Financial Crises Occur at Demographic Turning Points

Source: UBS Investment Research & The Financial Times (2016)

Longer life spans and reduced birth rates in developed countries will continue to increase the proportion of the aged and render central banks unable to increase interest rates. Historically low interest rates since 2007 have cost savers $630 billion yet there is still an extra $1.6 trillion in public sector liabilities existing today. If nothing is done such social security pressure will reach $17 trillion by 2050 (3x the current debt of the US and equivalent to $131,000 per American citizen).

More people now live to see an expensive old age and without at least $500,000 set aside for your retirement, you will be one of the 2/3rds of the American population expected to run out of money during the latter stages of life. On the governmental level later retirement and more immigration can mitigate the effects of an aging population. On a personal level diversification in a range of assets will reduce risk and investing in emerging markets can assure higher returns in the low inflation environment expected to be the new normal.