There is a palpable atmosphere of change in the world with United States President Donald Trump celebrating his first 100 days in office, the United Kingdom’s exit from the European Union and the resurgence of protectionism across many developed economies. Investors around the world are asking themselves three significant questions: Will such profound change in policy drive economic growth? What are the risks of this new global environment? How do I ensure sustainable wealth creation?

Change is seemingly welcome as the global economy shows promising signs of improvement. The International Monetary Fund expects global economic growth to rise from 3.1% in 2016 to 3.5% in 2017 and 3.6% in 2018. This is the first time in six years that the IMF has raised their forecasts. The recovery in investment, manufacturing and trade around the world has fueled global equity markets. Inflation has increased across the United States, the European Union and China. Commodity markets are even showing initial signs of recovery. Many believe that these changes indicate the end to the mediocre and low-growth economic environment experienced after the Global Financial Crisis. We remain cautiously optimistic, yet skeptical, of such a profound structural shift in the global economy.

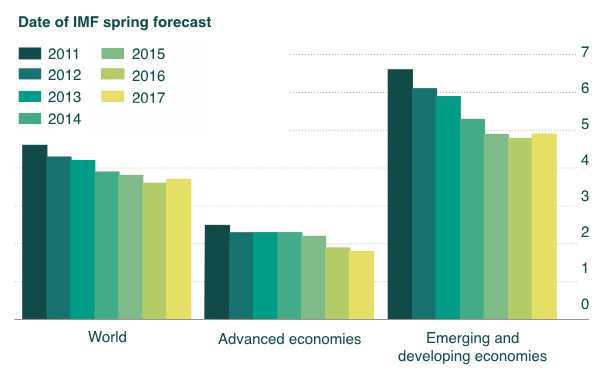

The End to Disappointing Growth?

Successive IMF forecasts for GDP growth, average of next 6 years starting from date of forecast (%)

Source: Financial Times (2017)

While global prospects have improved over the last year, current economic growth remains low. Both advanced and emerging economies seem to be settling into a pattern of growth that is underwhelming by historical standards. Governments remained heavily indebted as global debt levels rose to more than 325% of GDP in 2017, reaching an eye-watering $217 trillion. Lenders and investors are becoming increasingly more cautious as foreign direct investment flows declined by 13% in 2016 to an estimated $1.52 trillion. Central banks continue to implement unconventional monetary policy with over $12 trillion issued in quantitative easing programs over the past eight years. We are living in times of deflationary progress. Resources are used more efficiently, poverty continues to decline and life expectancy is improving despite this continued stalling of economic growth.

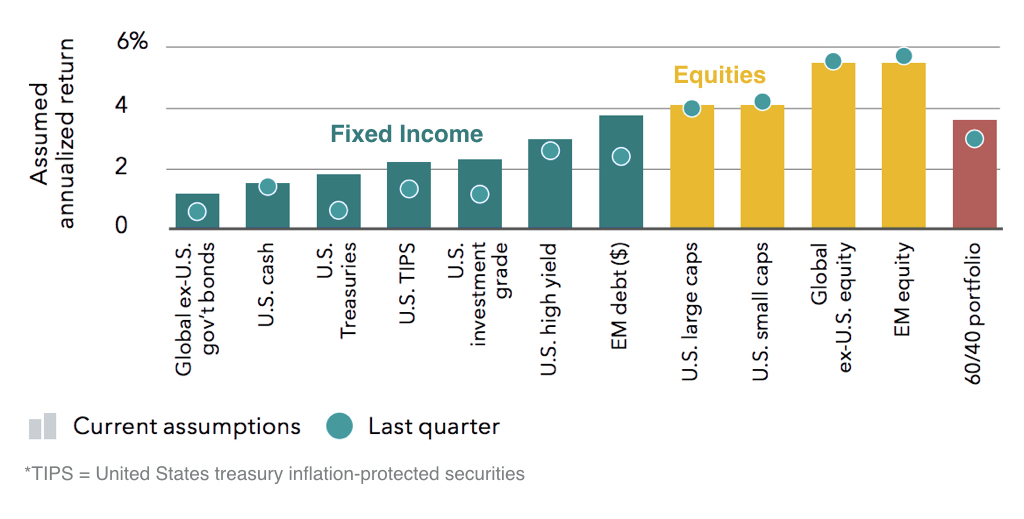

Structural dynamics, such as the unprecedented increase and aging of the global population, ballooning debt levels, low interest rates and continued monetary easing, are likely to keep investors in a historically low-return environment. Rather than focusing exclusively on the traditional path of broad equity and bond exposure, investors should be diversifying their portfolios towards factor-based allocations and alternatives that cater to the long-term requirements of society and the global economy.

Blackrock’s Five-Year Asset Class Return Forecast in US

Source: Blackrock (2017)

Source: Blackrock (2017)

Agricultural farmland is one such investment destination with significant potential. The fundamental drivers for agriculture are vital to humanity’s survival: an expanding global population and a limited supply of productive land. As an asset, farmland has demonstrated impressive performance in recent years, with the Savills Global Farmland Index recording an average annualized growth of 13% since 2002 and 7.5% over the last decade.