From agriculture, to water security and environmental protection, long-term investment strategies that strengthen the efficiency and longevity of our most fundamental resources, thereby sustaining life, creates true wealth.

2016 was certainly a momentous year. Brexit, Trump, record performances across global financial markets, a continued economic slowdown in China and the first signs of recovery for commidty markets all filled the headlines. While a new preference for more pragmatic and transactional political systems around the world will be good for geopolitical stability, the new protectionist trend has been interpreted as a clear move away from free trade, globalization and open market policies that have strengthened the global economy in recent years. There is confidence in the economy today, reinforced by the United States Federal Reserve decision to lift the benchmark interest rate for the second time since cutting it to near zero in 2008. For the first time since December 2008, the height of the global financial crisis, the Organization of Petroleum Exporting Countries (OPEC) cut its production in November 2016. Crude oil jumped more than 5% in the days after OPEC limited production to 33 billion barrels a day.

Global financial markets are still bracing themselves for the uncertain. The New Year is going to be more volatile and complex than the last due to deep social and political divisions that cross generations. Significant global issues such as mass migration, terrorism and climate change are causing significant concern around the world. Just as Britain’s decision to leave the European Union was a profound indicator of a Trump victory, other populist upheavals will likely follow. With current financial news flows progressing so rapidly, it is easy to get lost in current and often temporary trends. Markets rise and fall in the face of all headwinds. In a world where a single tweet can cost a firm over $4 billion in share price, real assets that fulfill mankind’s fundamental needs offer the best security. By taking a step back, we can look beyond the next few months and identify a number of persistent long-term global trends that range from shifting demographics, resource demand and an increasing tendency towards sustainability.

Goldman Sachs Predictions for 2017

Source: Goldman Sachs (2016)

Source: Goldman Sachs (2016)

The United Nations expect the global population to reach 10 billion by 2050, from 7.3 billion today. With the world growing by an average 200,000 people every 24 hours, calorie intake on the increase and arable farmland declining rapidly, the world will have to rely on efficiency-enhancing investments to drive sustainability across all sectors (especially agriculture). The supply of nutrients, resilient crops, and precision methodologies will help increase yields and ultimately fulfill the hunger needs of mankind. Food is fundamental for life and feeding more people makes both humanitarian and economic sense. Organizations that help increase resource efficiency, securing plentiful supply for our rising populations, will reap impressive rewards.

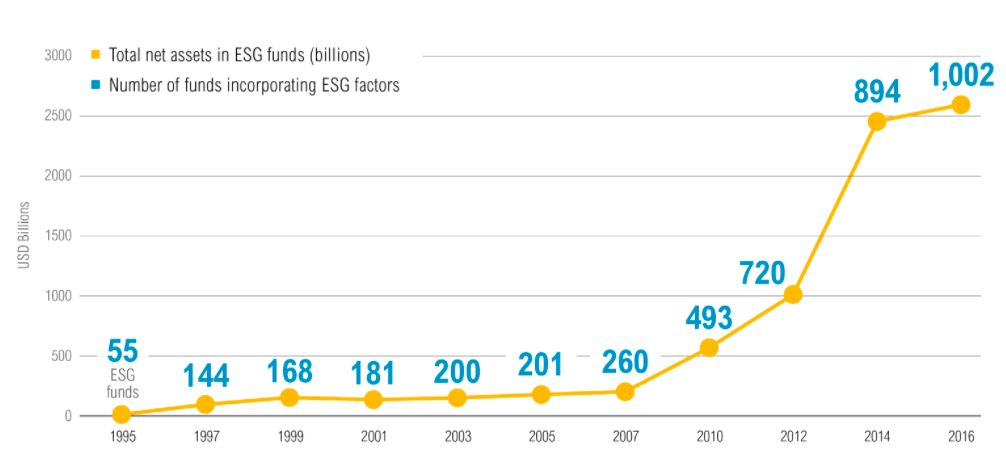

Investors have begun to seek structural growth from innovations in mankind’s most essential services such as agriculture, healthcare and energy that both increase sustainability and protect the environment. Essential for healthy and productive livelihoods that future generations can enjoy, sustainability is a key theme for investors and has profoundly influenced the way portfolios were managed over past few years. Over $6.5 trillion in professionally managed assets, 18% of all assets under professional management in the United States, were based on sustainability initiatives in 2014. That is a 76% increase from only two years earlier. Today, the amount has reached $8.72 trillion. The MSCLI KLD 400, the world’s first socially responsible stock index (launched in 1990), has outperformed the S&P 500 since inception.

Environmental, Social and Governance Assets and Funds

(1996-2016)

Source: World Resource Institute (2016)

Source: World Resource Institute (2016)

We all strive for a long-lasting and positive impact on the world. While there have always been financial gains made from sustainability, we are now reaching a turning point where this focus is becoming essential for human survival. Investing in agricultural projects that yield sustainability-enhancing products, strengthen global reforestation efforts and at the same time protect the environment offer in-built diversification and sustainable wealth creation. Neem is one great solution and 2017 will be a very exciting year for this powerful evergreen tree.