For the first time in history, social responsibility and sustainability initiatives are being demanded from the people rather than their politicians. The appetite for sustainable solutions is higher than it has ever been before. Society is no longer prepared to allow the damaging and unsustainable practices that degrade our earth. They are instead opting for strategies that maximize all forms of capital, including social, environmental and financial, in order to ensure a safe and lucrative future for all of mankind.

Socially responsible investing is the practice of considering both financial return and social good in investment decisions by relying on the power of the investor to influence the market through choosing projects that have a positive global impact.

.

.

.

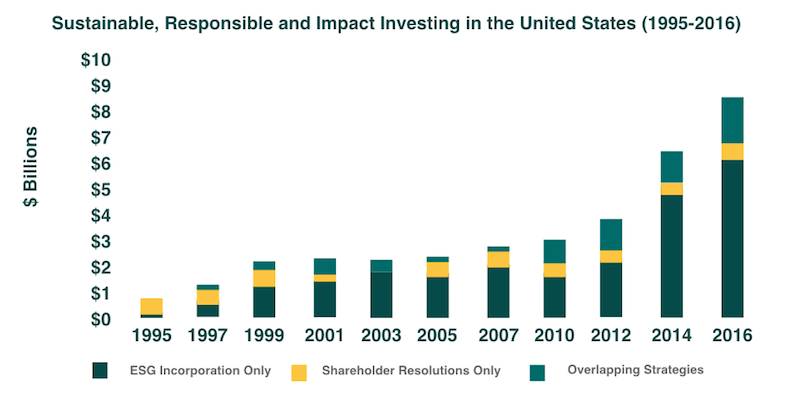

This profound shift in investor focus is still young and the market is growing fast. The first socially responsible investment vehicle of its kind open to public investment, UK-based Provident’s Stewardship fund, was launched a mere 30 years ago. The Forum for Sustainable and Responsible Investment (USSIF)’s bi-annual report on the industry showed that total assets in the US invested according to environmental, social and corporate governance criteria has now reached $8.72 trillion in 2016. That’s one out of every five US$ invested in the region today. It’s also important to note that this is by no means an American phenomenon; last year the European market for socially responsible investing grew 16% to €158 billion ($169 billon). That’s not to mention the $5.2 trillion that were divested from socially irresponsible initiatives such as fossil fuel assets last year.

Many of the world’s most wealthy and influential asset mangers are taking positive action. Over the past two years BlackRock, Goldman Sachs, Bain Capital and TPG launched or acquired their own impact funds. Generation Investment’s flagship investment vehicle, an $11 billion long-only global equity strategy, celebrated its ten-year anniversary by achieving an annualized return since inception of 12.14%. That’s more than the MSCI World Index for a period that saw the Global Financial Crisis, a Eurozone Crisis and the dramatic economic slowdown in China.

.

.

.

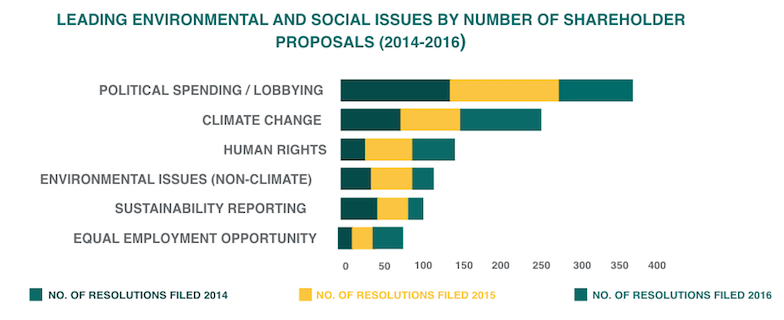

The shift towards environmental, social and governance criteria is not only breaching the asset management and investment space, but also businesses as a whole. Signatories to the Principles for Responsible Investment pledge to incorporate principles of ESG into investment analysis and decision making processes. The 1,5000 signatories with total assets of over $60 trillion include Allianz SE, the Lloyds Banking Group and many pension funds. 80% of Standard & Poor’s 500 companies also issue sustainability reports, which provide information on their economic, environmental, social, and governance performance..

At Primal Group our objective is to transform the archaic system of modern industrial agriculture into one that guarantees that nutritional needs are met in a safe, healthy and sustainable way. We believe in doing good for the world, by doing good business. That involves delivering positive returns for our investors while maximizing all forms of capital across our spheres of influence, including human, natural and financial.

We have the capacity to create a remarkably different future, one that can restore ecosystems and protect the environment while nurturing innovation, prosperity, employment and security. There is a great need in the world today to strengthen the economic, social and environmental systems in a way that prioritizes sustainability for the long term and we are working to be a fundamental part of the solution. This investment revolution signifies a huge adjustment in human behavior and represents a great opportunity to make the world a better place, secure survival and build wealth.