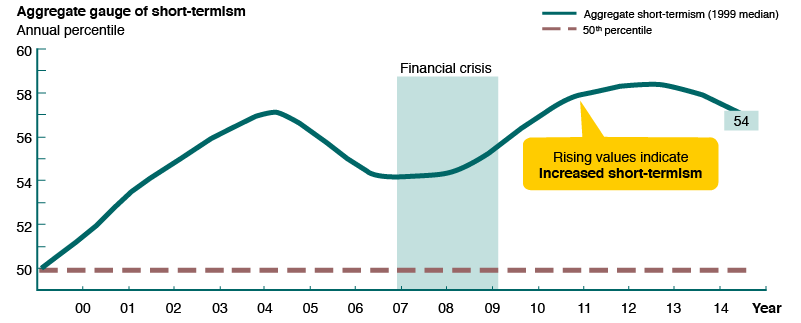

Corporate short-termism has reigned supreme across industry, despite hard evidence supporting the profound value of capitalism and commerce with the long term in mind. Business leaders, governments, and academic institutions are concerned that the corporate focus on quarterly earnings is preventing companies from investing in their workers, research and development as well as technological innovation. We must begin to drive the shift towards capitalism for the long-term in order to create true value; not only by adopting a multi-generational approach when solving the world’s grand challenges, but also by rewriting the very way in which we govern, manage and lead corporations.

In 1936, John Maynard Keynes noted that the horizon for investors was “three months or a year hence.” This sentiment has lasted and intensified over the years across business and financial markets. In the 1960s, the average holding period for US equities was eight years. Now the average share changes hands every 200 days for firms in the S&P 500. Business investment in fixed assets is at an all-time low, while the share of net income S&P 500 companies spend on buybacks is 30 times the share seen in 1981. This is due to unprecedented pressures to perform in as little time as possible, with financial results scrutinized on a quarterly basis now more than ever before. Nearly 80% of Chief Financial Officers of S&P 500 companies surveyed said they would sacrifice a firm’s economic value to meet quarterly earnings expectations. That’s not surprising given that these executives have a comparatively short amount of time to prove their worth. Average CEO tenure has dropped from 10 to six years since 1995, even though the complexity and size of firms have shown impressive growth.

The Rise of Short Termism in Business

Source: McKinsey (2017)

–

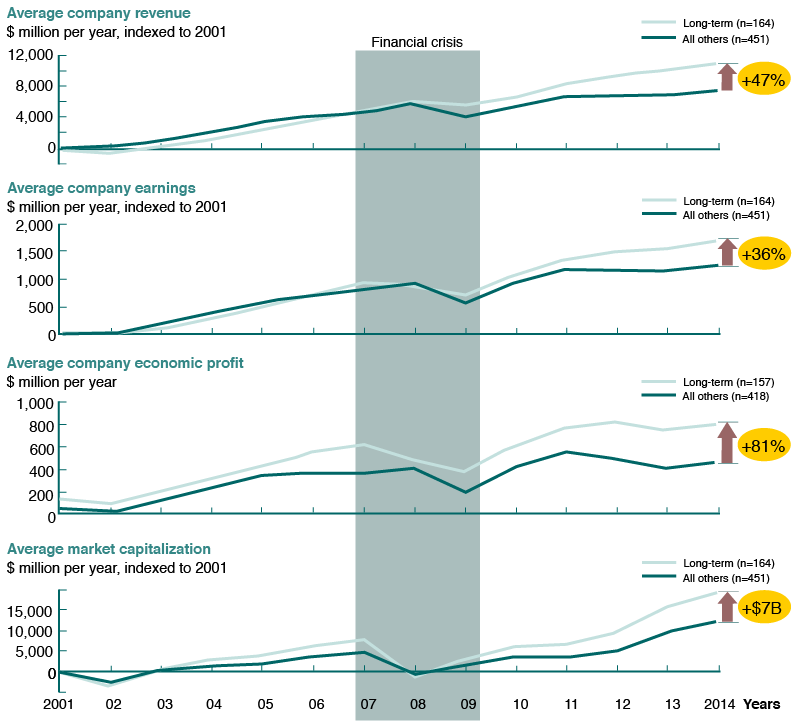

This focus on the short term is short sighted. The McKinsey Global Institute has found systematic evidence that proves a long-term approach in business will lead to superior performance in revenue, earnings, investments, market capitalization and job creation. From 2001 to 2014, the revenue of long-term firms studied increased by an average 47% over short-term firms, and with less volatility. Earnings of long-term firms grew on average 36% more and their profits outperformed by an impressive 81%. Long-term firms also exhibited stronger financial performance over time. On average, market capitalization of long-term firms grew by $7 billion more than that of short-term firms in the same period. Their total return to shareholders was also superior. Long-term firms created nearly 12,000 more jobs over other firms from 2001 to 2015. The potential value unlocked by companies taking a longer-term approach was worth more than $1 trillion in forgone US GDP over the last decade. By 2025, this additional value will reach $3 trillion.

Firms that focused too much on the short-term were also found to fail in our ever-changing world. For example, corporations such as Blockbuster, Sears, and Borders have all faced challenges and refused to consider innovation in their sectors. Blockbuster once employed around 80,000 people and owned over 9,000 stores around the world. The company then filed for bankruptcy in 2010 when rivals Netflix and Amazon diversified and offered delivery, streaming and original content production services. On the other hand, companies such as Unilever have thrived since introducing plans to increase investment in product optimization and innovation. They even dropped quarterly earnings reports in 2010 to focus on creating sustainable value for the long-term.

Long Term Firms Exhibit Stronger Fundamentals

Source: McKinsey (2017)

Primal Group focus on generating long-term value and sustainable wealth creation since inception. By investing in renewable resources across their agricultural projects, they will generate clean and sustainable power, while enabling 100% energy independence from the local grid. This will be achieved through the implementation of their Zero Carbon Footprint Plan that will give long-term results through the installation of solar panels. They are also active and participating members of the local communities in which they operate through the Sustainable Environment Partnership. By engaging in agricultural projects that will help to ensure a secure, accessible and long-lasting resource supply, Primal Group continue to adopt a multi-generational approach to solving some of the world’s most significant challenges.