A revolution is taking place in our global socioeconomic system as policy makers and financial heavyweights combine their resources to address some of the world’s most significant challenges such as food and water security, severe inequality of wealth, environmental degradation, conflict and mass migration. The fundamental objective of this new system is to build a safe and secure model for economic growth, development and prosperity that can be applied worldwide.

Financing for the United Nations Sustainable Development Goal Initiative, the objective of which is to address global challenges by creating a secure and mutually prosperous global economy, is pegged at up to $7 trillion per year. The World’s US $80 trillion annual economy creates environmental damages that are valued at this amount, and at current patterns of economic growth these are set to further erode natural wealth by over 10% by 2030. While public funding remains a significant and effective action, such an investment challenge requires new flows of private and commercial capital. Fortunately, we are now building the necessary channels for innovation across this space.

In addition to the 193 countries around the world who have agreed on a policy framework for the United Nations Sustainable Development Goals (SDGs) over the past year, a new global climate deal has been agreed during the UN Paris Climate Summit, an Action Agenda for Financing for Development was created in Addis Ababa, a Green Finance Study Group was initiated by the G20 Nations and a Task Force was created to deal with climate-related financial disclosures by the Global Financial Stability Board.

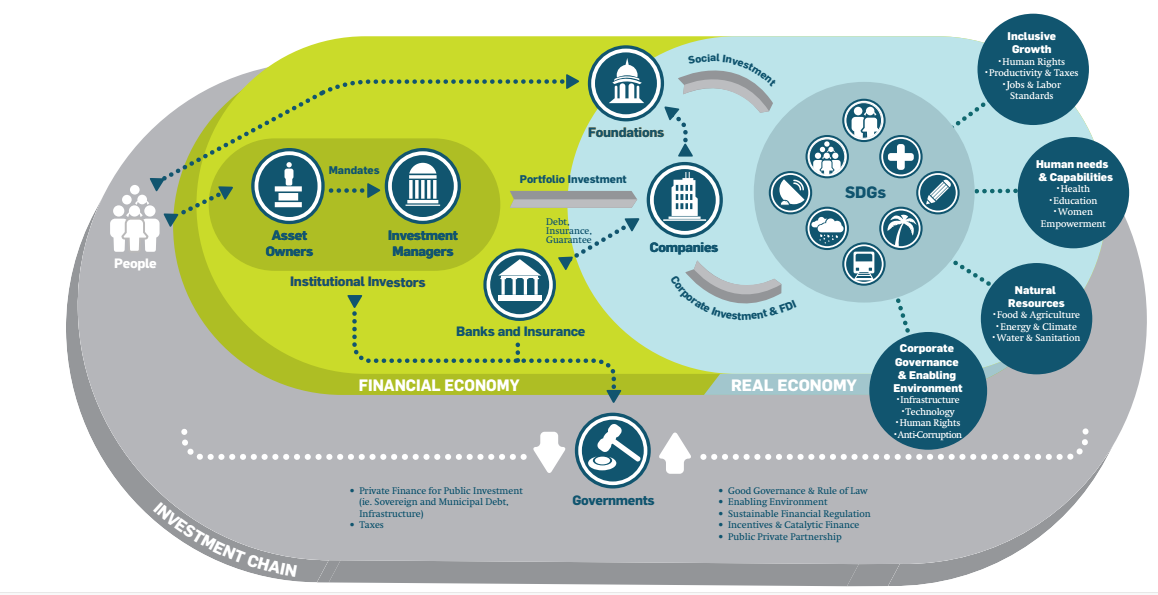

Global Investment Flows Directed by the People

Source: UNCTAD (2016)

Source: UNCTAD (2016)

The United Nations Principles for Responsible Investment are a voluntary and aspirational set of investment principles that strengthen environmental, social and corporate governance criteria in the global investment landscape. 1,500 signatories from over 50 countries around the world, managing over US$60 trillion worth of assets, have agreed to develop a more sustainable global financial system by allocating capital towards sustainable and socially responsible technologies and investment vehicles. Nearly 60 global stock exchanges, representing more than 70% of listed equity markets globally with a market capitalization of over $55 trillion, have joined the United Nations Center for Trade and Development Sustainable Stock Exchange Initiative. The Johannesburg Stock Exchange (JSE) and Brazil’s BOVESPA stock exchange were two of the earliest innovators in requiring such sustainability priorities and disclosures.

Investors, private companies and foundations are now playing an increasingly significant role in the design and implementation of a new financial strategy for global sustainability. This has been borne from the documented benefits of international development and mutual prosperity. As the global economy becomes more interdependent, businesses and investors become more aware of the alignment between public and private interests. The ability to prosper and grow on an individual and corporate level depends on the very existence of a sustainable society and economy. Social and income inequality as well as the pervasive degradation of our environment are having negative impacts on our supply chains, capital flows and employee productivity across the board. Financing a sustainable economy will require new capital flows to be redirected towards critical issues and away from assets that deplete natural capital.

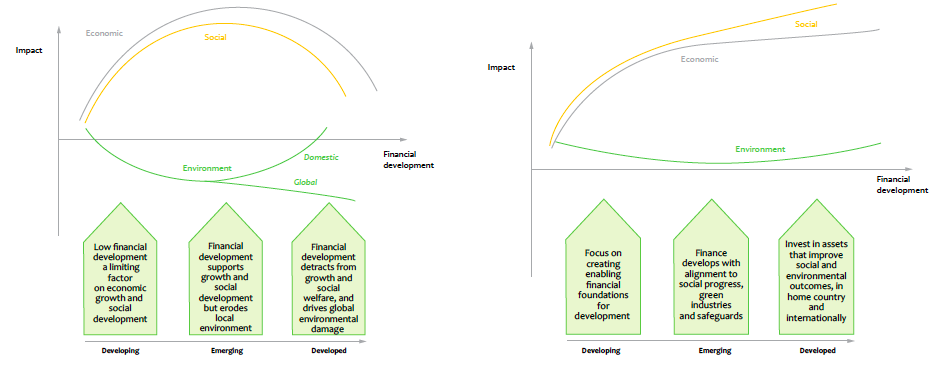

Business as Usual vs the Sustainable Development Model of Finance

Source: UNEP (2015)

Developing products and services that deliver social and environmental benefits while advancing the long-term objectives of the business itself will be achieved through the natural alignment of corporate and societal needs in the real economy. Participation in the real economy is a major driver of global economic growth as this involves a focus on basic services and human needs such as energy, telecommunications, agriculture, water security, education and health – all of which are crucial for achieving our sustainable development goals especially across emerging markets.

The organizations that participate in the real economy have a direct impact on sustainability in terms of climate, employment, infrastructure development and social services. Investors therefore have a responsibility to connect with sustainability issues through these companies by providing capital and engaging as active owners in projects around the world. Such projects range from property development, infrastructure, forestry and agriculture, helping to solve some of the challenges that have so far characterized the 21st century. Such foreign direct investment deserves particular attention as it represents the largest net flow of capital to developing countries, reaching $1.2 trillion in 2015.

Integrating socially responsible criteria into the evolution of a new financial system offers benefits across all regions of the world. For developing countries this will enable an increase in financial access, a reduction of environmental pollution and improvements in public health and economic development. Meanwhile developed countries can improve their market integrity, align the financial sector more closely to that of the real economy and enhance financial resilience in the face of economic adversity.

The financially efficient and sustainable global economic system that we are moving towards is necessary for true and long-term value creation. Not only will this reward responsible investment that is dedicated to solving some of humanity’s most pressing challenges but also benefit the environment and society as a whole for our future generations.