We have now reached the fourth round of renegotiations of the North American Free Trade Agreement (NAFTA), the largest free trade agreement in the world worth a staggering $17 trillion. Months have passed and little tangible progress has been made to date. With US President Donald Trump routinely threatening to leave the accord, Mexico is doubling down on free trade and turning toward allies in Latin America and the rest of the world.

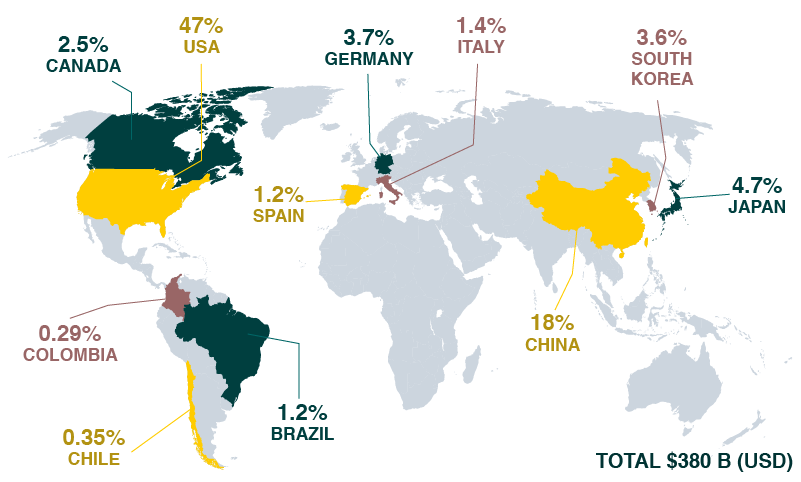

There’s no doubt that a dismantled NAFTA would cause some difficulties initially for Mexico. The United States is Mexico’s most important trading partner, worth $580 billion in 2016, accounting for 80% of all exports and the majority of agriculture imports. Even so, Mexico is taking the opportunity to strengthen their global trade opportunities, which extend to Europe, China and in particular, Latin America. Rather than risk the fallout of losing their most significant trading relationship empty-handed, Mexico is actively seeking new trading partnerships to reduce their reliance on the United States.

.

Where Does Mexico Import From? (2016)

Source: Observatory of Economic Complexity (2017)

.

Since the administration of Donald Trump began last January, the Mexican government has prioritized the renewal and creation of new trade agreements with many countries around the globe. Among these, we can highlight the partnership with China, whose currency (the Yuan) has been recognized by the International Monetary Fund as one of the reserve currencies in the world along with the U.S. dollar. Mexico got closer to this Asian superpower when president Peña Nieto visited China last month to discuss a growing collaboration covering financial, political, cultural and educational aspects with president Xi Jinping.

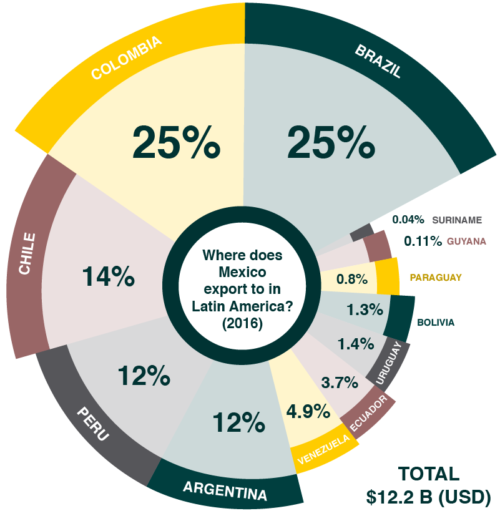

China has good reason to have Latin America on its radar. This year for the first time, 94% of goods moved tax-free across borders in the Pacific Alliance, a trading bloc including Mexico, Colombia, Chile and Peru that represent half of all trade in the region and is worth $3.7 trillion. MERCOSUR, the other major South American trade bloc featuring Brazil and Argentina, has also recently announced trade negotiations with the EU and Pacific Alliance in what can be seen as a clear sign of globalization policies continuing without the inward-looking US under President Trump.

What about agriculture? The US is the world’s top exporter of agricultural products, but there are other global breadbaskets, including Brazil, Australia, Russia, Argentina, and Ukraine. As these rivals have adopted more modern agricultural practices whilst improving their transport and product-handling infrastructure in recent years, America’s global export share has steadily declined. Mexico is also currently in talks with Brazil to establish a new trade agreement for agricultural products.

Mexico is serious about this new trading partnership with Latin America’s biggest economy, taking 17 companies to Brazil earlier this year to talk about new business prospects. Diversifying away from North America towards Brazil, especially when it comes to agriculture, may be one of the best and smartest options Mexicans have. Brazil’s has a resource-rich environment, which offers the largest freshwater reserves in the world, 300+ million hectares of arable farmland (an abundance only matched by undeveloped areas in Africa) and a domestic market of 200+ million with a growing middle class. As one of the world’s future breadbaskets, agriculture is the star of the Brazilian economy. The OECD-FAO Agricultural Outlook expects Brazil to be world’s largest exporter of agricultural produce by 2020. Brazil’s strong and globally competitive fundamentals make the country an exciting investment destination.

.

Source: Observatory of Economic Complexity (2017)

.

While NAFTA is still of great importance for the Mexican economy, its annulment or renegotiation doesn’t leave Mexico without options. The path to diversification that the Mexican government is consolidating towards Latin American economies such as Brazil and economic giants like China or the European Union is key to understanding the new global opportunities Mexico is pursuing without the US as the lynchpin. This strategic move for wider-reaching national alliances is undoubtedly one of the best solutions for Mexico when diversifying their risk exposure and reliance on NAFTA.