How can an industry focused on financial returns generate a truly positive global impact? The answer is alarmingly simply – align investment strategy with environmental, social and corporate governance criteria to generate sustainable returns and shared value.

A quiet revolution has been underway in the responsible investment arena for over a decade. For the first time in history, social responsibility and sustainability initiatives are being demanded from mainstream investors rather than their politicians. The Global Sustainable Investment Alliance estimated that environmental, social and corporate governance integration in investment strategy reached an unprecedented $10.4 trillion in 2016, up 38% from 2014. The market for impact investments – injecting cash with the explicit intention of achieving measurable social or environmental impacts as well as financial returns – swelled by an even greater 57%across the same timescale. This is one of the world’s fastest-growing asset classes, increasing by a third from $14 trillion to $22 trillion globally in the last four years.

.

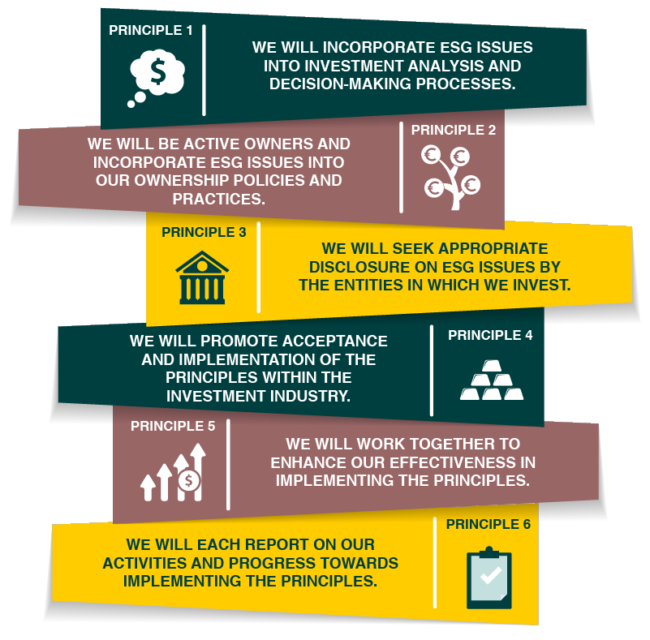

Principles of Responsible Investment (PRI)

Source: UN, Principles of Responsible Investment (2017)

.

Many of the world’s most wealthy and influential asset managers are taking positive action. Over the last few months Japan’s Government Pension Investment Fund (GPID), the world’s largest with $1.3 trillion under management, has selected three ESG indices to track for around $9 billion. Swiss Re, one of Europe’s main insurers, announced plans to benchmark its entire $130 billion portfolios against ESG indices. Over the past two years BlackRock, Goldman Sachs, Bain Capital and TPG launched or acquired their own impact funds. Generation Investment’s flagship investment vehicle, an $11 billion long-only global equity strategy, celebrated its ten-year anniversary by achieving an annualized return since inception of 12.14%. That’s more than the MSCI World Index for a period that saw the Global Financial Crisis, a Eurozone Crisis and the dramatic economic slowdown in China.

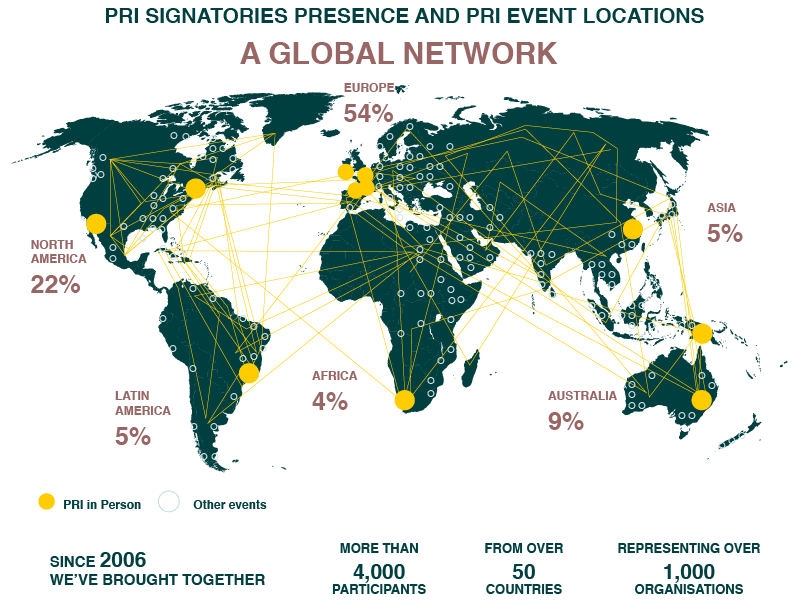

Since the United Nations Principles for Responsible Investment (PRI) were introduced in 2006, the number of signatories including the Vanguard Group, Fidelity Investments, Lloyds Banking Group and other mainstream investors has risen from 100 to 1,784 around the world. This represents a combined total of assets under management at an impressive $60 trillion.

.

Source: Blue Print, UN Principles of Responsible Investment (2017)

.

Why so much interest in responsible investment? The world is facing a host of slow-motion crises such as overpopulation, excessive resource consumption and climate change that only long-term planning and continued resource allocation will fix. These global grand challenges will require trillions in new capital every year. Alongside playing a significant part in the solution to these challenges, investors are of course looking for market leading returns. The success of responsible investment strategies is beyond doubt. Four indices compiled by FTSE Russell, a leading provider that selects companies involved in energy efficiency, water technology, and other green applications, have outperformed their benchmark FTSE Global All Cap Index. The trend is particularly pronounced across emerging markets. The MSCI Emerging Markets Leaders Index, which includes 417 countries that score highly on ESG considerations, has outstripped the dominant MSCI Emerging Markets benchmark for the last decade.

At Primal Group, our objective is to evolve a sustainable future by transforming the archaic system of conventional agriculture into one that guarantees that the nutritional needs of the world are met in a safe, healthy and sustainable way. Our main investment thesis is that mission-driven entrepreneurs outperform. We are firm believers in doing good for the world, by doing good business. That involves delivering positive returns for our investors while maximizing all forms of capital across our spheres of influence, including human, natural and financial.