Global GDP

Demographics

Agriculture

Agribusiness

Brazil is strengthened by its resource-rich environment, with the latest 2015 OECD-FAO Agricultural Outlook stating that the country will be the world’s largest exporter of foodstuffs and agricultural produce by 2020. It has more freshwater than any other country, twice as much as Russia (its closest rival) and circa 300 million hectares of arable farmland. Brazil is also the world’s fifth largest country both by size and population and its seventh largest economy, nominally and by purchasing power parity. It has a large (200 million plus) population, 63% of which the government classifies as being ‘middle class’ or above.

While the flow of poor global economic data is playing its part in Brazil’s current malaise, it also reflects a wider realigning of portfolios.

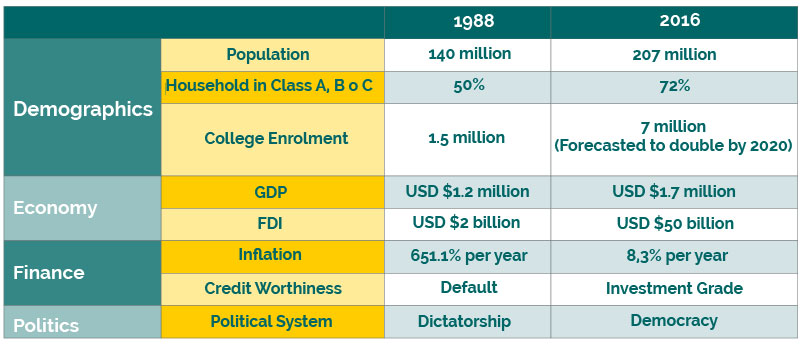

A Profound and Positive Change in Brazil Over the Last Quarter Century

Source: World Bank, McKinsey, and Primal Group (2017)

And that’s the way it is with Brazil. The country represents everything attractive and challenging about the longer term higher returns likely to come from emerging markets. In fact, the country has so much potential that it is difficult to think of a more attractive developing market with more opportunity when demand picks up and the current cycle turns, as it inevitably will.

There are two reasons to think that Brazil will be able to recover from its current difficulties quicker than the consensus expects, enabling the country to position itself attractively for recovery in emerging markets and commodities.

The one export sector in Brazil that continues to show consistent improvement when it is already a world-class producer is agriculture. This is the one area that, quite wisely, successive governments have steered away from interfering in. The figures speak for themselves; agricultural volume output doubled between 1990-2013, while livestock production trebled over the same period. Agricultural based exports accounted for 36% of total exports in 2013 ($86 billion) and that figure will continue to rise while the currency remains highly competitive. Productivity in the sector continues to improve due to the introduction of more capital-intensive production. Brazilian agriculture accounts for 13% of the workforce and 5.5% of GDP. Issues the government is tackling concerning the poor infrastructure, complex tax regulations and bureaucracy will undoubtedly help boost prospects for the sector, which includes the production and export of livestock products such as beef, poultry, veal, and pork.

Our assessment is that the current softness of the Brazilian Real represents an exciting opportunity for investors looking for an ideal entry point. With the Chinese economy growth rates normalizing to a slower pace, a wholesale correction across commodity prices since 2011 and the Fed finally having taken the plunge in increasing interest rates and starting their tapering program, currency devaluation has become a widespread trend across emerging markets. Brazil, one of the largest and most significant of these, has shown no exception.

By investing in Brazil when the currency is low, one is effectively buying into the undervalued market. The Real’s depreciation is currently being compounded by a range of domestic issues and in particular corruption scandals within government and the country’s energy corporation (and national proxy) Petrobras. This has undermined the value of the Bovespa. More positively, the electorate has now become more demanding and steadfast in their refusal to accept any more corrupt antics from the country’s politicians and captains of industry – a fundamental accomplishment and structural adjustment that can only help underpin and strengthen the economy.

With fiscal reform lowering taxes on inbound capital flow, a persistent removal of corruption and the dawning of a more conservative era, we are convinced that the Brazilian Real will become a more sought after, viable and lucrative diversification vehicle.

Since Brazilian President Michel Temer’s centrist, pro-business government came into power following the impeachment of leftist predecessor Dilma Rousseff, a series of groundbreaking and necessary policy moves have taken place to the delight of investors around the world. Determined to restore his country’s star status on the global economic stage, Temer is pushing forward with his significant fiscal reform programs that made the Ibovespa and the Real some of the strongest market performers around the world in 2016. Although 2017 has marked a more flat return from the Brazilian markets, expectation remains for the Brazilian Real to continue its strengthening towards a target rate of US$1/BRL$2 in coming years.