.“It is clear [that] the transition to a clean energy future is inevitable, beneficial and well underway, and that investors have a key role to play.”

Ban Ki-moon, Former Secretary-General of the United Nations

.

Over $300 billion was spent on renewable energy initiatives in 2016 alone. This is a profound indication that global leaders and businesses are recognizing the dangerous impact fossil fuel energy production has on our environment, while also appreciating the great financial opportunity that exists in clean and renewable alternatives.

Every 24 hours, the burning of fossil fuels for 85% of the energy that powers the Earth spews 90 million tons of carbon dioxide (CO2) into our atmosphere. Since the dawn of the new millennium, each year mankind has been responsible for emitting 40 billion tons of carbon dioxide into the air. This has had a profound impact on our environment, contributing to the loss of 46,000 square miles of forests, 12 million hectares of arable land and 10,000 species. According to the US Health Effects Institute (HEI), air pollution killed an estimated 4.2 million people around the world in 2015. The health effects of pollution are incredible: the 92% of people residing in areas with polluted air are at risk of dementia, short-term memory loss and abnormal brain metabolic ratios, along with death. There are also financial implications hidden within public and private health expenditures, military budgets, emergency relief funds, and the degradation of sensitive ecosystems. The International Monetary Fund estimates that the global use of fossil fuels costs taxpayers and consumers $5.3 trillion every single year.

In a world facing rapid population growth, a changing climate and the pervasive depletion of our most vital resources, the need for energy will only increase. The Organization of Petroleum Exporting Countries expect primary energy demand to see a 40% increase by 2050. Our survival therefore depends on a transformative change in the energy sector towards renewable sources.

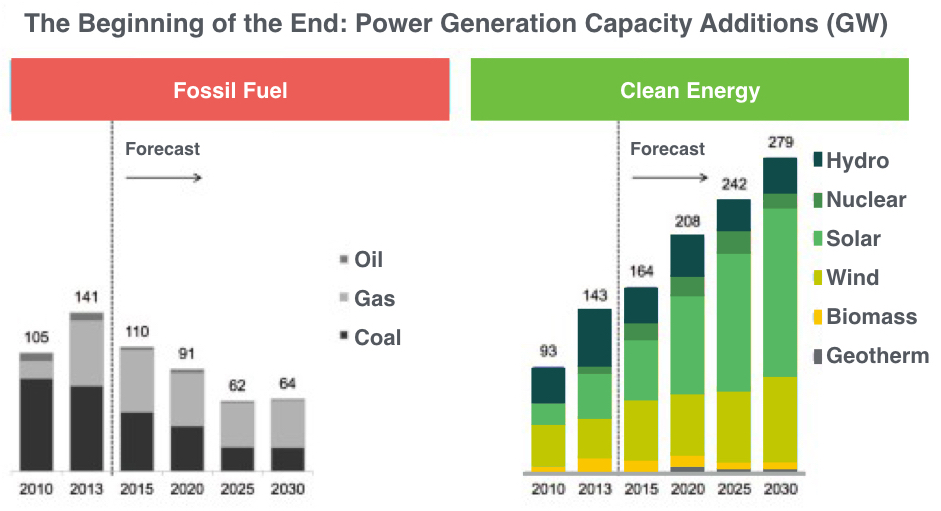

The first steps are already occurring in the form of fossil fuel divestment. The value of investment funds committed to selling off fossil fuel assets soared to $5.2 trillion in 2016, doubling from levels seen in the previous year. The value of fossil-fuel consumption subsidies dropped in 2015 to $325 billion, from almost $500 billion in 2014, reflecting not only lower fossil-fuel prices, but also a subsidy reform process that has gathered momentum in several countries. The reason is simple – polluting fuels are expected to lose 10% of market share within a decade.

Source: Bloomberg New Energy Finance

Source: Bloomberg New Energy Finance

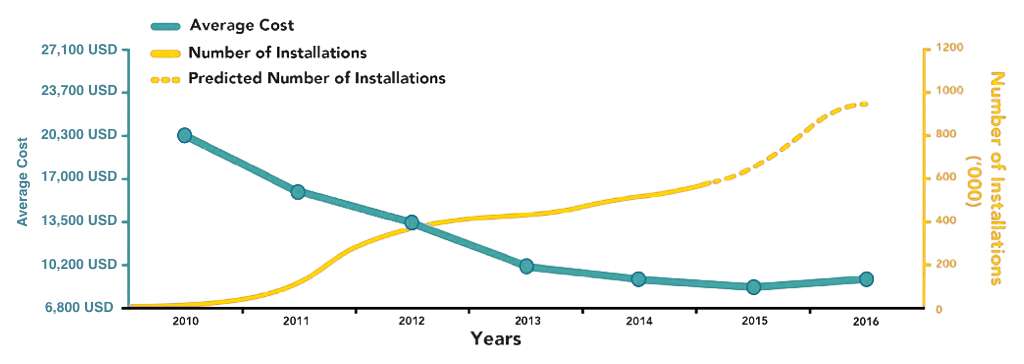

Renewable energy, such as wind and solar power, carries few negative impacts at increasingly competitive prices. The cost of solar has fallen by 85% in the last seven years, with panels capable of supplying 23% of global power generation by 2040. By 2035, electric vehicles are expected to make up 35% of the road transport market. Nearly 60% of all new power generation capacity for 2040 will come from renewables. This falling costs and increase in generation of renewable energy are expected to halt the increase of global demand for fossil fuels by 2020.

Comparison between Demand Vs Cost of Solar Energy

Source: The Energy Collective

Source: The Energy Collective

Such profound movements towards clean energy, in line with the global commitments made during the COP21 Climate Summit in Paris, would limit global temperature rise to between 2.4ºC – 2.7ºC above pre-industrial levels. This would help protect our environment for future generations, while laying the groundwork necessary for an entirely clean and renewable energy supply that would become the foundation for innovation and prosperity for generations.

The only way to do business in this current macroeconomic climate of political change, financial market uncertainty and climate emergency is to behave in new ways that benefit both people and the planet. This is why we at Primal Group are actively driving the global shift towards clean energy. The Zero Carbon Footprint initiative across our agricultural projects in Brazil will see the demands of our on-site facilities and irrigation systems met entirely through renewable means, allowing us to truly drive the new wave of sustainable business.