Over the last few months, the world’s political and corporate leaders have made hard commitments fundamental to human life and prosperity – ending extreme poverty by 2030 and limiting global warming to 2C above pre-industrial levels among others.

There is a new global agenda to develop advanced education and health systems worldwide, provide decent livelihoods for a growing population and construct urban and rural infrastructure underpinned by sustainable technologies. In financial terms, the new agenda will require trillions of dollars in global investment.

Now is the time to make 2016 ‘a Year for Green Finance’, with the world’s foremost investors (representing $20 trillion in combined wealth) gathered at the United Nations in New York last week to focus their efforts on clean energy projects, curbing the planet’s rising carbon emissions and ensuring a sustainable resource supply.

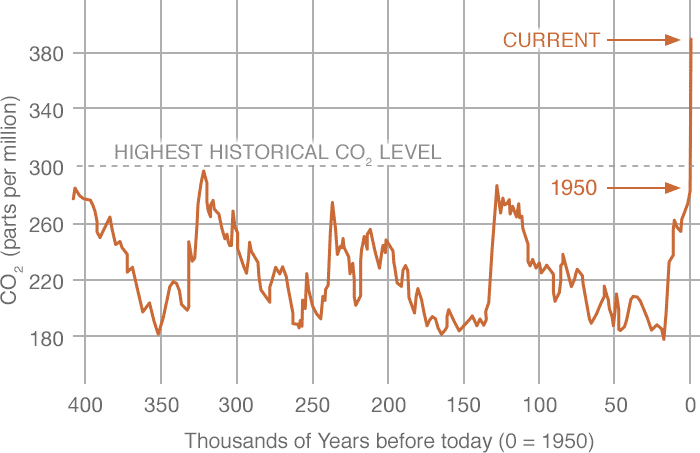

Historical Carbon Dioxide Levels in the Atmosphere

Source: NASA (2015)

The good news is that we are already on our way. Investments in green energy and low carbon technologies have seen a six-fold increase since 2004, totaling $330 billion in 2015. $41 billion of which was invested in green bonds for sustainable infrastructure in developing regions of the world. This has also proven to be profitable – 14 funds holding over $1 trillion in assets could have saved $22 billion over the same period if they had shifted investments from the highest carbon companies to those that receive at least 20% of revenues from environmental or agricultural markets.

One solution discussed at the World Economic Forum and the COP21 Climate Summit was carbon pricing. This program offers a win-win opportunity for climate and the economy, with revenues helping to balance budgets, boost employment generation and reducing inequality around the world. The Portfolio De-carbonization Coalition, a joint initiative between the United Nations Environmental Programme and the world’s major funds and asset managers, announced last month that over $600 billion in assets have been committed to de-carbonization. This is six times the collation’s original target and is a clear indication of where the smart money is going.

Reforestation is another viable opportunity in restoring carbon levels in the atmosphere. Deforestation and forest degradation produce as much as 15 percent of the world’s annual greenhouse gas emissions. Forest conservation, restoration and development must play a meaningful role in any successful effort to avoid dangerous climate change. Planting trees can produce valuable crops that help sustain life while strengthening the environment that we call home. According to the United Nations, agricultural investment is one of the most important and effective strategies for economic growth and poverty reduction in developing economies.

Achieving these hugely demanding goals will require financial, human, and technical resources far beyond those of governments and international organizations. Investors need to know how the impacts of a changing financial and natural environment can affect specific companies, particular sectors and life as a whole. The solution remains in the straightforward investment in sustainable projects and a move away from the dangerous practices of our past. Business interests and initiatives to build a better world are pulling in the same direction. This is not only about corporate social responsibility – sustainable development is becoming an integral part of the global business model.