“Seven years after the Global Financial Crisis (GFC), 2015 closes a chapter on an innovative financial experiment that is unprecedented in both its scale and longevity – quantitative easing (QE). By making liquidity freely available when markets were on the edge of depression, and at a time of record low interest rates, private consumption would theoretically be stimulated and corporations would take the opportunity to invest. In practice, the blend of low interest rates and excess capital fuelled the hunt for higher investment returns. Companies began registering record profit margins and stock markets have been pushed to all time highs, boosted by high levels of share repurchases. This newfound willingness to take on more debt has ultimately inflated valuations across the board and risks causing great volatility within the global financial markets.

The International Monetary Fund (IMF) is now stressing that the prolonged access to cheap credit has increased risk-taking, not only in stocks but also in high-yield and investment grade bonds.

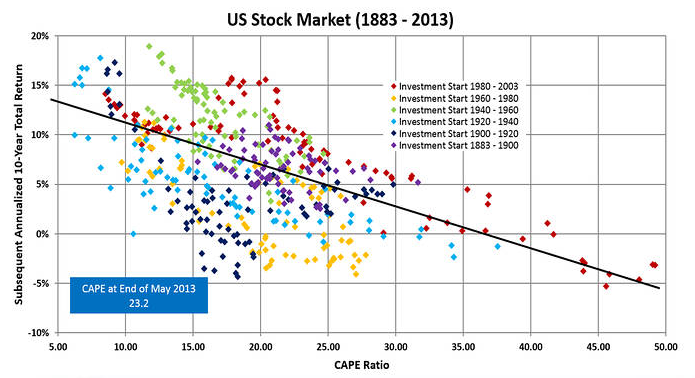

Even the Fed’s comments in 2015 about the pending end to QE did nothing to dampen investors’ expectations. The S&P 500 has continued to climb, causing many to question whether the market is overvalued. Taking the simplest and most recognized market valuation indicator, the price-to-earnings multiple, and utilizing the more accurate Shiller cyclically adjusted price-to-earnings model (CAPE), the S&P 500 is currently trading on 25.5x against a historic average of 18x since 1950. This means that the market would have to drop by 40% to revert back to its long-term average. The market’s valuation has only been higher on three previous occasions – the Wall Street Crash in 1929, the Dot-Com Bubble in 1999 and the start of the GFC in 2007.

A New Era for Low Stock Returns

Source: Wall Street Journal (2015)

Spreads in the leveraged loans market have widened and are at levels similar to where they were pre-GFC, while the quality of loans is actually declining. A sell-off in the corporate bond market at this point would simply cause extreme levels of volatility in the markets and the repercussions would be felt worldwide.

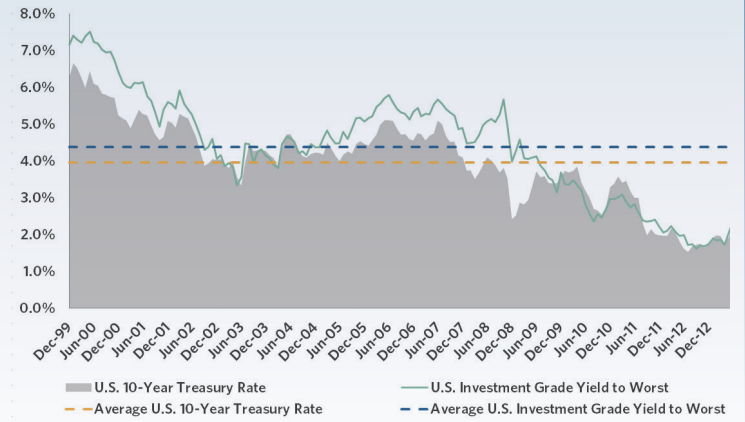

A New Normal for Low Bond Yields

Source: US Federal Reserve, Barclays (2013)

Returns for these traditional asset classes since the turn of the new century, even accounting for the beneficial impacts of QE, have still remained lower than historic averages. According to Credit Suisse, annualized returns for the global equities index during 2000-2012 were only 0.1%. Real bond returns have also remained at 6.1% due to a rapid fall in global interest rates.

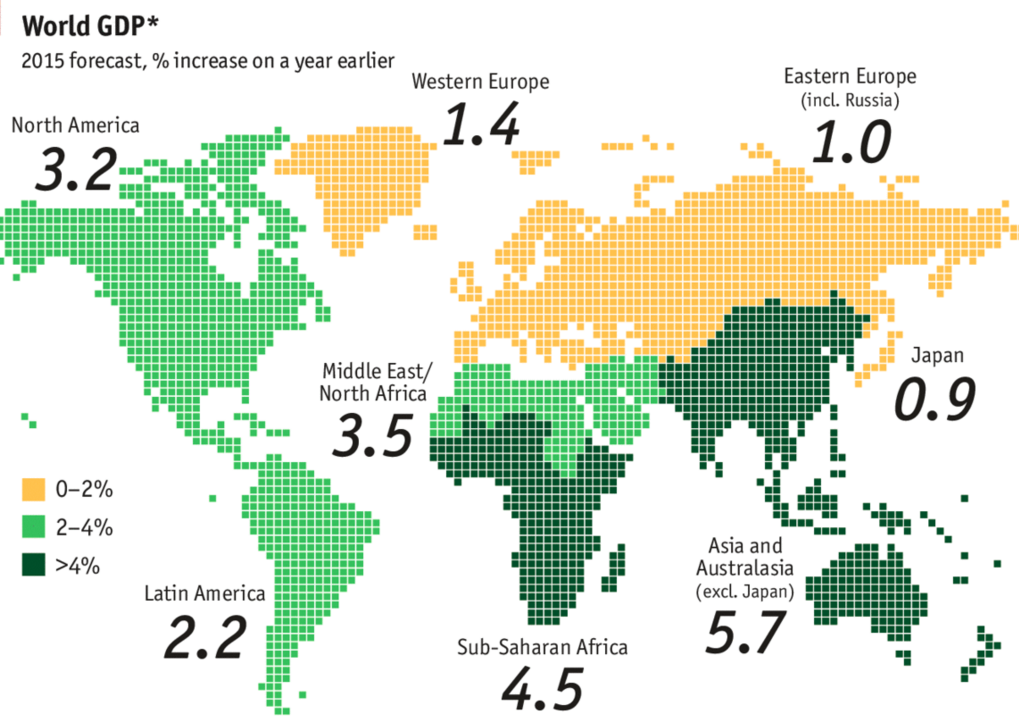

The global macro economic picture also provides little encouragement. Though showing a slight marked rebound in 2014 and 2015, growth forecasts have been downgraded. This is due to the dire conditions in the Eurozone, Japan and China. In both the Eurozone and Japan central bankers are more concerned about deflationary than inflationary pressure. China is growing at its slowest rate in 27 years of 7.4%. The rate of recovery in the US over the past five years, although showing promising levels of growth, has in fact been the slowest in recent memory. The resulting price fall in commodities was not the ‘shot in the arm’ for global growth as expected, but instead is a reflection of weakening global demand.

Source: The Economist (2015)

Regarding future prospects, the OECD’s long-term forecast for the global economy paints a bleak scenario, with an average 2% growth expected across OECD states and 3% growth for the rest of the world over the next fifty years. This is a substantial downgrade to the 7% average growth experienced in the first ten years of this century.

The current global economic climate, alongside a ‘new normal’ investment returns outlook for traditional asset classes, are causing investors worldwide to diversify away from equity and fixed-income products and towards an alternative asset base. Long-lived physical assets that generate stable cash flow streams, provide enhanced yields and offer attractive risk-adjusted returns are becoming a preference. By 2030, allocations to physical and alternative assets among institutional investors is expected to reach 20-30% of total portfolio value, with some institutions allocating upwards of 50% to the asset class. This transition in portfolio allocation towards alternative assets has only just begun.